Why it pays to understand which part/s of your international program will best respond to a loss

Knowing what protocols to follow when a claim arises will ensure you get the most out of your international program, wherever in the world a loss occurs.

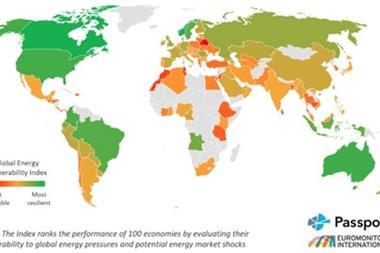

Multinational companies with assets around the world face a changing risk landscape, which creates new challenges and calls for a joined-up approach to their international program.

Cyber-attacks, supply chain disruption, climate change and natural disasters, and ongoing geopolitical and economic upheaval are just some of the exposures that global businesses face.

But due to the interconnected nature of these risks, it is important that your subsidiaries - wherever they may be based - understand that the international program consists of both a master policy and complementary local coverages.

Knowing exactly what is covered in every local policy, and the respective limits and conditions, is unrealistic, but clear protocols should be followed when reporting claims, for instance to ensure you get the most out of your program.

If a claim is declined locally, how will indemnity from the master policy be explored? If a local policy claim is settled, is there more cover from wider wordings and/or higher limits in the master policy? These are questions that you should work with your carrier and broker on when the program is placed.

Where DIC/DIL comes in

The overarching aim of an international program is to make sure you get a level of cover globally that matches, to the extent possible, the cover provided by the master policy in your home territory.

In most cases, and particularly for Casualty and Financial Lines programs, the master policy will offer wider cover and higher limits than the local policies. This additional cover can complement what’s provided by your local policies.

With Property programs, customers typically aim to replicate the master policy as closely as possible in the local policies.

One way master policies achieve this is through difference in conditions (DIC) and difference in limits (DIL) cover. The DIC/DIL component of the international program gives the risk manager confidence and certainty about the level of cover and limits of insurance they have purchased.

Here is a real-world example which highlights the importance of understanding how your international program will best respond and the value of the DIC/DIL covers.

A leisure group opened a new hotel abroad which then suffered a major property loss because of a typhoon. The local policy was limited and did not include cover for damage to the hotel’s gardens. It also provided cash value cover and not full replacement value, again limiting the local settlement.

Furthermore, local regulation stated that business interruption cover was only applicable to facilities that had been in operation for at least 12 months. In this case, the hotel had been open for fewer than 10 months and so BI cover was excluded from the local policy settlement.

In the master policy - by contrast - there was no time limit excluding BI cover. It also offered wider wording for the property damage, which included the gardens and paid out based on full replacement value.

The overall loss suffered by the hotel ran to millions of dollars and three-quarters of the total paid was picked up by DIC cover from the master policy.

It demonstrates the value of DIC/DIL cover in providing additional indemnity to that offered by local policies in the event of a loss.

Reto Collenberg is Head International Programs APAC and EMEA, Swiss Re Corporate Solutions.

Creating consistent cover on a worldwide basis is an ongoing challenge that will take time to deliver. To advance the market further in this direction, Swiss Re Corporate Solutions has developed a standardised wording for property damage and business interruption policies called ONE Form.

ONE Form is currently issued by all Swiss Re Corporate Solutions’-owned local offices and is beginning to be used by select network partners.

No comments yet