North America

Register for free with StrategicRISK

Unlock full access to award-winning journalism tailored for senior risk professionals. StrategicRISK goes beyond the headlines, offering in-depth analysis, exclusive case studies, and global insights designed to help you anticipate threats, shape strategy, and lead with confidence.

If you are already registered, please sign-in for access.

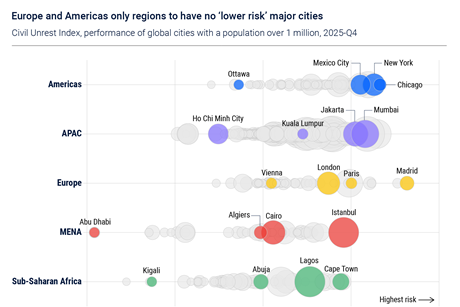

Civil unrest risks set to intensify in 2026: what businesses need to know

New analysis points to rising protest size, more frequent disruption and growing damage to commercial property, with Europe and the US emerging at the highest risk of becoming SRCC flashpoints

Geopolitics, cyber shocks and insolvency pressures reshape D&O risk for 2026

Boards head into 2026 facing escalating exposures across geopolitics, cyber security and financial distress. Directors now operate in a liability landscape defined by faster scrutiny, more severe claims and intensifying regulatory expectations.

Secondary perils: Why businesses must strengthen resilience as severe weather intensifies

Rising losses from floods, hail, wildfires and other under-recognised hazards show that secondary perils are no longer secondary. New data highlights the scale of the threat – and why risk managers need a more systematic, site-specific approach to resilience.

Sector spotlight: why universities must rethink risk in an era of disruption

Once defined by tradition, universities are now facing degrees of change that are forcing a fundamental rethink of how they fund themselves, how they manage student interests and their approaches to handling evolving technological threats.

Risk briefing: Tariffs will test corporate resilience and risk strategy

Escalating tariff regimes and shifting global alliances are reshaping the risk landscape. For risk managers, the priority is building the intelligence and supply chain resilience needed to navigate rising volatility and protect growth.

Elemental exposures: what changing natural hazards mean for global risk leaders

New analysis from Hiscox highlights the shifting pressures behind global natural hazard exposure and what they mean for corporate resilience.

Risk briefing: how to protect your employees and business through civil unrest and riots

As tensions continue to simmer across the globe in 2025, StrategicRISK speaks to experts about how organisations can navigate an increasingly volatile landscape and safeguard their people on the ground.

From economic slowdown to AI disruption: the emerging risks keeping executives awake

Gartner’s latest survey finds risk leaders under pressure to manage the dual challenge of economic stagnation and AI disruption as emerging risk signals multiply.

The uninsurables: how climate change is redrawing the global insurance map

Intense climate volatility combined with risk-based pricing is pushing traditional insurers to retreat from entire regions across the globe. With no safety net, businesses and communities are left to confront the rising cost – and painful consequences – of uninsurable risk.

Commodity traders face geopolitical turbulence, Willis warns

Tariffs, maritime disruption and regional conflicts are reshaping global commodity flows, as a Willis report highlights the sector’s exposure to escalating geopolitical and geoeconomic risk

Employee anxiety emerges as a critical organisational risk

New research from Cigna Healthcare and the American Psychological Association reveals rising anxiety across the workforce, creating an escalating challenge for employers seeking to protect wellbeing and productivity.

Regulation Watch: US insurance regulators move from AI guidance to mandates

The RIMS Public Policy Committee outlines AI’s impact on insurance regulation, as US oversight shifts rapidly from voluntary standards to something more binding.

Soft market, shifting ground: why mining risk managers must hold their nerve

Mining insurers are cutting rates and expanding capacity, creating tactical opportunities for buyers. Yet WTW’s latest analysis points to tightening scrutiny on tailings, seismicity, flooding and project approvals. The right move in a soft cycle is not to ease off, but to turn cheaper premium into stronger resilience.

SR Q3 2025: This is what it sounds like

In a world shaken by extremism, inequality and climate crisis, it’s easy to feel powerless. Yet risk managers can drive real change. We shine a light on those of us who are pushing boundaries, working tirelessly to reshape governance and proving business can be a force for good.

Opinion: The guy who created risk management says we messed up

Alex Sidorenko, chief risk officer and founder of RISK-ACADEMY highlights Grant Purdy’s warning that risk management has strayed from its purpose, becoming compliance theatre instead of genuine decision support.

Firms face rising risks in accessing external data

New research from Decodo highlights how budget constraints, technical barriers and outdated tools are hampering firms’ ability to access external data. Risk managers are warned that without robust, compliant approaches, organisations face both operational and reputational risks.

New IUMI paper highlights fire risks and safety gaps in EV shipping

The International Union of Marine Insurance (IUMI) has updated its guidance on the carriage of electric vehicles at sea, adding new evidence on gas hazards, peak heat, ship design constraints and the limits of current firefighting systems. The paper explains where risks are evolving and how operators and insurers should ...

Steel-zero: new research shows why risk managers must prepare for policy-driven change

A major new study warns that carbon pricing alone will not deliver the transition to clean steel, with big implications for businesses reliant on the metal.

Spotlight on: the growing reputational risks threatening charities and NGOs

Charities and NGOs are losing ground on reputational resilience, WTW warns, leaving them exposed to fast-moving risks that could damage trust, funding and their mission.

The convective storm surge and what risk managers can still control

How a fast-rising weather peril is reshaping insurance markets and forcing risk managers to rethink their approaches.