Voluntary agreement expected to become common practice on all property and BI claims

AIRMIC (the Association of Insurance and Risk Managers) has reached final agreement with seven of the UK’s largest commercial insurers on a scheme to promote the prompt settlement of big claims.

The Statement of Principles applies to all property and business interruption claims above £2.5m on UK-issued policies. It sets out a framework for such losses to be compensated.

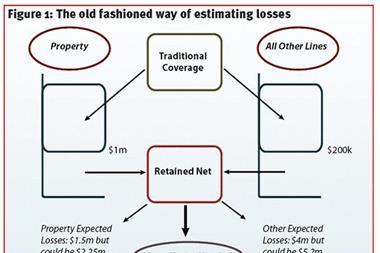

Under the terms, a loss adjuster would produce a cashflow model for the period of interruption caused by a major event. This would show how much the insured had lost in terms of production and sales at any time. The insurer would undertake to protect the client’s cashflow position, ensuring that it remains as close as practical to how it would have been in the absence of any loss.

Although voluntary, use of the agreement is expected to become common practice. Insurers that sign up must give a written explanation whenever they choose not to abide by its terms.

AIRMIC has been pressing for agreement on speed of payment ever since the credit crunch made it more difficult for firms that suffer major property losses to acquire bridging capital from their banks, except at prohibitive cost.

“The improved cashflow will make a big difference to companies that have been hit by big losses such as fire damage.

Kip Berkeley-Herring

“This statement of principles is great news for AIRMIC members, and it shows that the insurance industry can respond positively to its customers when they express legitimate concerns,” said the chair of AIRMIC’s insurance steering group, Kip Berkeley-Herring.

“The improved cashflow will make a big difference to companies that have been hit by big losses such as fire damage. In some cases it may even make all the difference to an enterprise’s survival chances,” said association chief executive John Hurrell.

“This is a workable solution that meets the needs of our commercial customers. We believe that the statement of principles will ease the claims process and provide them with increased financial certainty, especially in the current economic climate,” said Tracy Jones, technical claims manager at Zurich Global Corporate UK, one of the people involved in the discussion.

“The phrase ‘cash is king’ is especially relevant in these challenging economic times and we hope that this protocol goes some way to help our clients in this respect,” said Martin Henson Head of Non-Marine Claims at Allianz Global Corporate & Specialty.

The Chartered Institute of Loss Adjusters, whose members will play a pivotal role in making the agreement work, was also involved in the discussion.

No comments yet