Our 2023 climate change survey shows businesses taking compliance seriously but falling short on funding, let alone real action. Can risk managers light a fire under such tepid board engagement?

Sustainability and climate-related regulations and disclosures are the main reasons risk managers are focusing on climate risk, but boards are only somewhat engaged, and approaches for managing and monitoring the risks are only partially embedded within most corporations.

This year’s global climate risk survey indicates improvements where the risk manager’s efforts are concerned. But in all other areas, including board engagement and climate prioritisation, progress remains subpar. So, what’s stalling momentum?

With the Task Force on Climate-related Financial Disclosures (TCFD) becoming part of the regulatory framework in many jurisdictions and soon-to-be mandatory in the UK and New Zealand, it joins a long list of climate-related disclosures that corporations are reporting to, including the EU Corporate Sustainability Directive, IFRS 1 and 2, and more.

“Climate risks are predominately treated as a compliance issue. The management of the risks comes secondary to this – and this needs to change.”

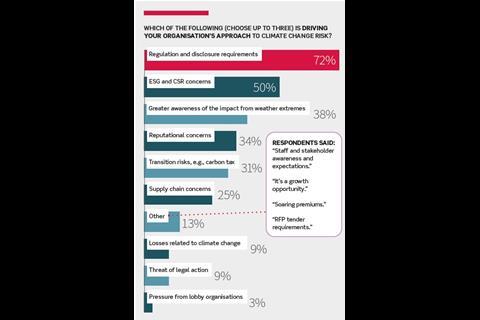

It is unsurprising then, that the majority – 72% of respondents (a 30% increase on last year) – say regulations and disclosures are driving their organisation’s approach to climate risk, ahead of ESG and CSR concerns and reputation risk, at 50% and 34%, respectively.

In line with this, 31% said that transition risk is driving their organisation’s focus on climate, which is indicative of the importance risk managers place on compliance (with many disclosures requiring organisations to detail how they are or intend to reduce emissions).

Compliance is an opportunity

But compliance should not be the main impetus, says Valentina Paduano, chief risk and compliance officer at Dedalus Group and chair of FERMA’s sustainability committee.

She says: “The fact that the first reason given by respondents is related to regulation indicates that climate risks are predominately treated as a compliance issue. The management of the risks comes secondary to this – and this needs to change.

“While regulations provide a push in the right direction in terms of investing in a more structured process, sustainability isn’t about compliance. Instead, it should align with the strategic direction of the business.”

Still, the compliance stick has its uses and should be promoted internally as an ‘opportunity’.

“It is fundamental that risk managers engage with climate risk – and this is their opportunity to change the perception that climate risk is about compliance.”

“For example, the Corporate Sustainability Reporting Directive requires risk managers to report on their risk-based approach for double materiality assessment,” explains Paduano.

“So, it is fundamental that risk managers engage with climate risk – and this is their hook, their opportunity to change the perception that climate risk is about compliance and drive greater awareness across the enterprise.”

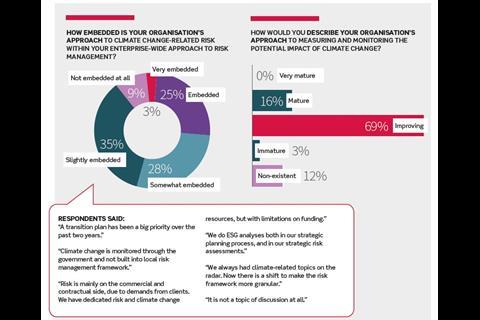

Perhaps we’re beginning to see some of this ‘opportunity’ being taken up by risk managers, particularly in how they measure and monitor risk – an area where 69% see improvements.

Of course, there is still progress to be made in terms of embedding an approach across the enterprise. Here only 25% say that their approach is embedded.

“Unfortunately, low board engagement typically equates to a lack of financial backing, which is needed to make a success of any formalised climate risk policy.”

For the majority, their approach is only partially embedded, at 62%. And even this partiality can be broken down into varying levels of ‘slightly embedded’ (34%) and a degree higher than this at ‘somewhat embedded’ (28%).

Challenges could include difficulties in operationalising climate-related risk management strategies; trouble obtaining buy-in and support from different parts of the business; or a lack of necessary resources and expertise to fully embed climate change considerations into an overall risk management approach.

Annacel Natividad, chief risk and finance officer at Pilmico Foods Corporation, based in Philippines, says: “Unfortunately, low board engagement typically equates to a lack of financial backing, which is needed to make a success of any formalised climate risk policy.”

Lacking influence

Natividad, who is the incoming chair for PARIMA, questions the level of involvement risk managers have: “The data provides some illustration of the risk manager’s position and influence: that they sit slightly outside of the sustainability agenda and may only have slight involvement in creating a climate and sustainability approach.”

This, coupled with a lack of board access, is problematic, says Franck Baron, group deputy director risk management & insurance at International SOS, founding chairman of PARIMA and president of IFRIMA.

When there is strong engagement, real change takes place, he says: “We have a strong protocol at International SOS in terms of our lines of communication with the executive committee and the board on risk issues, including climate.

“Risk managers sit slightly outside of the sustainability agenda and may only have slight involvement in creating a climate and sustainability approach.”

“The risk team advise on how the business should approach climate risk and as such the business has adapted how it develops its services and support its people and its clients.”

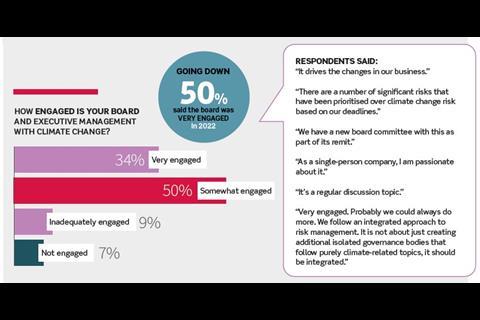

But the survey suggests this level of engagement isn’t the experience of the majority. Boards who sit in the ‘very engaged’ category fell by 32%.

The majority (50%) sit in the middle ground of ‘somewhat engaged’, which may seem positive, but was a surprise for many of the risk managers who were interviewed and involved in the analysis of this research.

Just lip service

“It is true that a lot of companies are declaring their ‘green’ targets,” says Paduano. “But I question how many of these declarations are simply marketing communications versus having a concrete understanding of the sustainability agenda and effective commitments to back the targets.”

Natividad agrees: “What is surprising is the relatively high percentage of somewhat engaged responses. What it suggests is that many boards are making some effort but that they might not be fully committed to addressing climate change.

“This is likely to be because of the financial implications of becoming environmentally sustainable.”

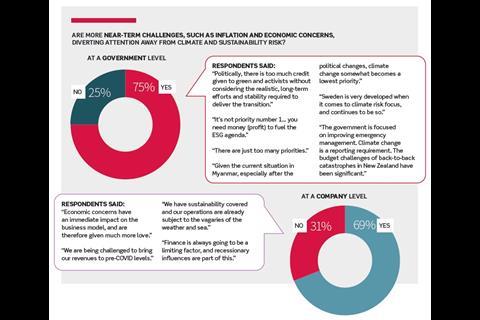

Indeed, this is reflected in the data: 69% of respondents say near-term economic challenges linked to recession are diverting attention away from climate and sustainability risks.

As one respondent put it, Climate risk is “not priority number 1, you need money (profit) to fuel the ESG agenda.”

“Many boards are making some effort but that they might not be fully committed to addressing climate change.”

Paduano says this sentiment is felt across most organisations: “To achieve carbon neutrality, for example, you may need to undertake a complete restructure of manufacturing and production sites.

“Companies may need to invest in new equipment and create a completely new process. So, if companies find themselves grappling with economic challenges, then this could impact the need to invest in sustainability.”

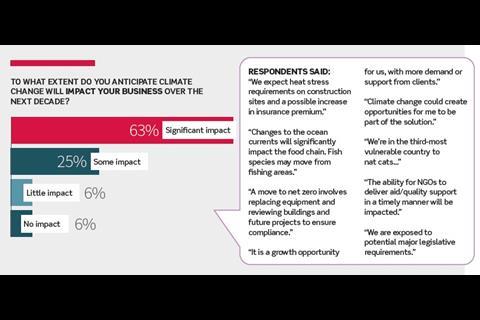

Clearly, climate and sustainability risks take a backseat to more near-term economic challenges. But this needs to change, particularly for the 63% of respondents who anticipate that climate risks will affect their business in the next decade (compared to only 6% who believe it will have no impact).

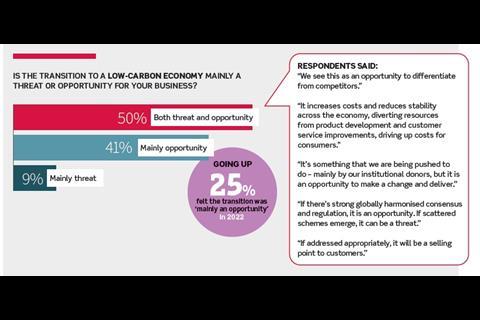

This dovetails with data indicating that 50% of risk managers see the low-carbon economy as an opportunity.

We need to move past prevention

Ultimately, boards need to back their climate transition statements with the necessary investment, because “climate change is already here,” warns Alessandro De Felice, chief risk officer at Prysmian Group.

“The words ‘climate change’ are no longer fit for purpose,” says De Felice, who led the company’s TCFD approach in partnership with his chief sustainability officer (see our case study here).

“They inaccurately suggest that the world’s climate is going to change but climate change has happened. Just look at the frequency and severity of extreme weather events; and mass immigrations owing to uninhabitable environments where drought is high and water supplies are critically low.”

He adds: “If climate and sustainability isn’t a priority now, then it must be made a priority. Because the truth is, climate risk is no longer a matter of prevention. It’s a matter of control.”

Physical vs transition risks

The effects of global climate change are being felt in a very real way, says International SOS’s Franck Baron. Yet worryingly, less than a quarter of respondents view it as a physical risk, anticipating only third-party impacts.

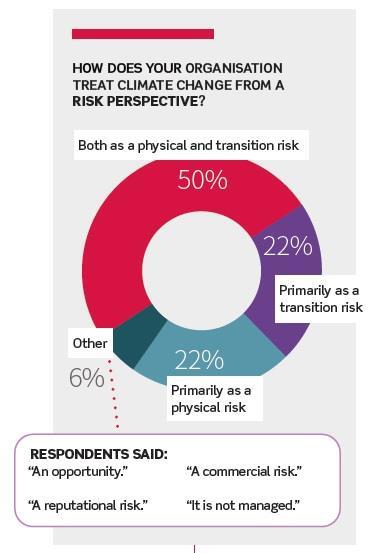

Half of respondents treat climate risk as both a physical and transition risk and only 6% treat climate as a physical risk.

The ‘other’ category (of which 22% of respondents selected) delivered interesting results.

Here, risk managers have described climate risk as: “a superficial strategic risk currently”, or “a commercial risk”, or said that it is simply “not managed”.

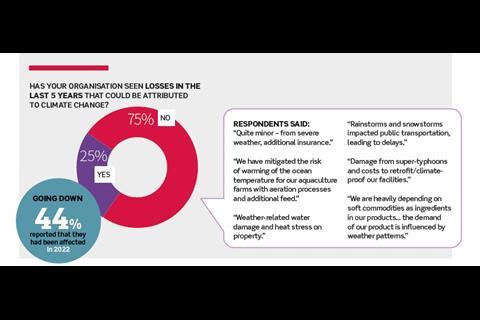

Respondents’ loss data provides an interesting perspective on this: only 25% say they’ve experienced a loss attributed to climate in the last five years.

Of this percentage, a staggering 81% say the losses did not impact their business directly, suggesting third-party losses to their supply chain or elsewhere.

For Baron, these statistics are worrying. They suggest a lack of understanding or appreciation for the physical impact climate risk brings.

He explains: “Climate risk routinely impacts us all – physically. Look at the spectrum of nat cats, which ranges from earthquakes to wildfires, flooding and more. They are happening more and more and are less and less predictable.

“It may be that the impact is further down the supply chain, as the data suggests. In this regard, the parent company won’t be looking at the second- or third-tier supplier as being a potential insured loss. So, a lot of risk managers are not getting the information about it.”

This research and further analysis appears in our Climate Change report, which can be read here.

No comments yet