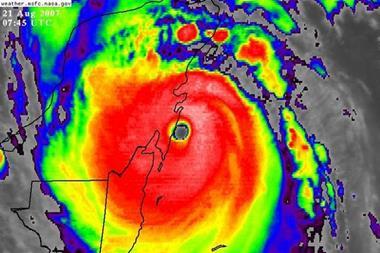

Hurricane Katrina in 2005 cost the insurance industry $40.6 billion to settle 1.7 billion claims for damage to homes, businesses and vehicles in six states, according to the Insurance Information Institute (III). Hurricane Andrew, the previous record holder, resulted in $15.5 billion in losses in 1992 ($22.2 billion inflation adjusted to 2006) and 790,000 claims.

The III says that although some insurers in some coastal states are not writing new homeowners policies, none has withdrawn entirely from any state. Coverage is available in every state, either through private insurers or a state operated insurance company.

In areas vulnerable to hurricanes, rates have been rising in recent years, and they will continue to do so. This is because the frequency and severity of catastrophic storms is expected to grow for decades to come, according to the III.

“While 2005 was by far the worst year ever for insured catastrophe losses in the United States, future storms could prove even costlier, reaching upwards of $100 billion,” warned Dr. Robert Hartwig, III president. “The total value of insured coastal exposure nationwide is more than $7 trillion. Florida and New York have the most insured coastal property, at more than $1.9 trillion each. After Florida, the states of New York, Massachusetts and Connecticut have the highest coastal exposure as a share of all insured exposure in their states.”

The second quarter of 2007, nevertheless, was one of the lowest for natural catastrophes in the United States during the last decade. The Property Claim Services (PCS) Unit of the Insurance Services Office reported six catastrophes between April and June and damages of $2.18 billion. The most costly event of the quarter, a storm with strong winds, large hail, tornadoes and flooding in mid-April affected 18 states and the District of Columbia. The damage estimate for this event is $1.225 billion.

An independent survey conducted in May 2007 for the III found that even though almost two-thirds of the public (64%) believe there will be more severe natural disasters in the future, only 14% of Americans have a flood insurance policy, only one out of five has taken steps to protect their home from a natural disaster and less than half the respondents (46%) said that they would pay more for a home built to withstand a natural disaster.