Green hydrogen could be a key component of a carbon-free future but there are significant hurdles to overcome

As the world seeks to reduce its dependence on fossil fuels and develop a carbon-free future for energy production, ‘green hydrogen’ is increasingly being seen as a key element of a carbon-free future for power and energy.

Many feel it could be a key component of a carbon-free future, but there are significant challenges associated with scaling up production and repurposing existing fossil fuel infrastructure.

Engagement and innovation on the part of the insurance and risk management sectors will be crucial to developing innovative solutions that will ensure a burgeoning green hydrogen industry is both commercially viable and as safe as it can be.

Untapped potential

As a fuel, hydrogen can be burned to produce electricity or used to power fuel cells. Hydrogen fuel cells are already being used in cars, buses, vans and lorries around the world - and diesel-driven container ships could in the future be powered using liquid ammonia produced using hydrogen.

In the industrial sector, hydrogen-powered turbines could replace natural gas for power generation, and hydrogen could replace coking coal in steel production.

In the domestic sphere, hydrogen boilers could take over from traditional natural gas boilers for heating and hot water.

The economic opportunities surrounding green hydrogen are substantial and wide ranging.

A significant advantage of transitioning to hydrogen as a low-carbon alternative is that existing fossil fuel storage and distribution infrastructure could be re-purposed. However, this transition comes with a novel set of risks and challenges that need to be addressed.

Producing green hydrogen

Hydrogen is often championed as a more environmentally friendly alternative to fossil fuels on the basis that it can be created from nothing more than water. A process of electrolysis is used to separate out the hydrogen and oxygen in water.

Another advantage is that the waste product generated by burning hydrogen is, again, water – not carbon dioxide, as is the case with fossil fuels.

There is, however, a point of balance here. Hydrogen can only be considered a ‘true’ green energy source (on a par with solar or wind) where the electricity used to power the electrolysis process has been produced by renewable means (rather than by the use of fossil fuels).

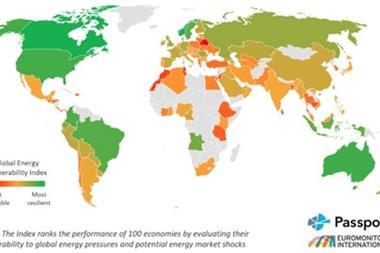

This ‘green input’ requirement has implications in terms of both cost and consistency of supply. However, it also creates opportunities. Countries which have a substantial potential for renewable energy generation due to consistently high solar irradiation levels and/or strong and consistent winds may be ideally placed to develop green hydrogen industries.

Because renewable energy cannot be stored for long periods without significant investment in battery storage systems, it makes sense to use some of the energy generated to create either hydrogen or liquid ammonia, which can be stored and transported for use as an energy source elsewhere.

Green hydrogen production also raises some other challenges: firstly, locating a suitable and plentiful supply of water for production (in a world where water security is an increasingly fraught issue in its own right); and secondly, finding safe, effective and commercially viable methods of storing and transporting the product.

Storage and transport issues

As a gas, hydrogen occupies a greater volume than comparable fossil fuels, taking up nearly four times the space of natural gas. Compressing the gas or supercooling it into a liquid form drives up cost due to the energy required to perform either process.

There are also some practical issues. Unlike fossil gases, hydrogen atoms under pressure are small enough to permeate some engineering alloys, including steel, causing ‘hydrogen embrittlement’ and potentially making the material susceptible to catastrophic failure.

This means that effective retrofitting of existing infrastructure and equipment will require a reliable solution to this problem – whether through the use of new alloys or hydrogen-resistant coatings.

The energy risk management community’s experience of the risks associated with transporting liquefied or compressed hydrogen will be invaluable in this respect.

Making green hydrogen insurable

Whatever solutions are devised for managing the risk of hydrogen embrittlement, risk managers in the energy sector will need to work closely with the insurance market to develop a better understanding of the risk and tailor products that are adapted to a rapidly developing area of specialist engineering.

For green hydrogen production to be cost-effective at scale, the efficiency of the electrolysis process will need to be improved through the development of new electrolysers - with implications across the design, supply, manufacture and construction links of the supply chain, not to mention the potential for novel property and business interruption (BI) exposures.

There are also professional, general and product liability exposures for owners of green hydrogen assets, the engineers and other contractors involved in building and maintaining those assets, and the designers and manufacturers of new infrastructure and machinery.

Business interruption exposures for companies impacted by a major leak and/or fire/explosion will also need to be considered.

In the event of a major disruption in hydrogen production, there is the additional consideration of BI exposures for producers and suppliers, and contingent BI for customers of green energy suppliers.

Green hydrogen producers also need a consistent electricity supply for the electrolysis process. This may present a challenge given that some renewable energy sources cannot always be relied on for uninterrupted power output. This will need to be factored in when assessing the risk profile of production facilities.

Risk financing and management

Taken together, the risks associated with green hydrogen present significant challenges – but also significant opportunities - along the energy supply chain. Risk managers, (re)insurance brokers and carriers will need to put their heads together to develop suitable risk financing solutions for this emerging industry.

Risk managers and insurers will need to kept informed of developments in engineering, and will likely have to deploy additional capacity and expertise to meet the potential demand for cover.

While bespoke insurance products for the green hydrogen economy are in development, insurance coverage for this emerging sector is still in its infancy, according to Lloyd’s, with only a few insurers to date offering specialist cover for hydrogen risks.

However, while innovative products may be needed to address new production and distribution technologies, in the near term there is a feeling in the (re)insurance sector that cross-class solutions may be the best way to leverage existing industry knowledge about property and liability risks covered in the energy markets, to produce tailored solutions for a growing green hydrogen industry.

Tim Searle is a partner at Clyde & Co

No comments yet