“Companies are not only looking at their own risks, but also taking into account that the ‘Made in Germany’ tag may make them vulnerable if terrorists want to attack Germany itself” warns Johannes Jung, of German-based broker, Gebrüder Krose

Q&A with Johannes Jung, Gebrüder Krose

Q. How significant is the risk of terrorism for DVS members? How is this developing?

A. The risk is significant and developing all the time, and people are becoming more and aware all the time. The media is helping this by making people aware of what is happening around the world. Years ago companies were just thinking about their own exposure, and because of this they may have been coming to the conclusion that because they were not a controversial firm, they were not a big bank or an arms manufacturer, they were based in Germany, and they didn’t operate a strategic industrial plant, then they were not at risk. The terrorists will look elsewhere. But this has changed. Now firms are not only looking at their own risk in terms of what they do, but rather that the ‘Made in Germany’ tag in itself my make them vulnerable if terrorists want to attack Germany itself. In a similar way, certain luxury goods manufacturers may be attacked for what their product represents. For this reason companies have to look at their risk on the global scale. They also need to look at the local scale – who else is operating nearby? Are they a likely target? Could their plant be damaged if someone else is attacked.

Q. Do you think German businesses take these risks seriously enough? What more could they be doing?

A. They are taking this seriously, definitely. We deal with the top 100 companies and we see companies, their risk managers, their insurance managers, they all look seriously at these risks and they are asking for quotations on terrorism insurance. In addition, because over the years the premiums on this cover have gone down and this is also drawing more people to take up cover.

It is always hard to introduce new products. Everyone has fire cover but not everyone yet has terror cover. But decreasing premiums can help change this. Prices have really dropped from a high in 2002.

Q. Is the market responding to businesses’ needs?

A. Yes. In many countries there are local terrorism insurers that can provide coverage according to local needs, and they have huge capacity backed by the state and this works fine. When we look at the international scene, the London market has plenty of cover, underwriters, companies and syndicates that will write that risk. We frequently see the situations where either a firm will take the local cover in Germany and go to London for their international cover, or that they will go to London for all their cover.

In the last few years the London market has been more willing to adjust the coverage to the needs of big German clients.

It’s also worth remembering that in some countries there are compulsory terrorism pools. In this case, the global cover from London will exclude the location or provide DIC/DIL coverage. For non-compulsory local pools, like Pool RE in the UK, of course the client can chose.

Q. It seems to be a good time to be buying this kind of cover?

A. Yes indeed. In particular, not just because premiums are at a low, but because if you look to the future, the situation could change in the light of a big attack causing underwriters to become more cautious and capacity to evaporate.

If the situation changes, then capacity will be given to existing clients.

Q. How are underwriters approaching the risk?

A. Like in other cover, like property, where you may have a global sum insured, and insurers ask for a list of properties and values to be covered. In terrorism it is even more strict. Underwriters demand a schedule of addresses and values per location. This is first of all important for the capacity they provide, which depends on the locations and local risks. It also affects they premiums. And also, when we build up a programme, the value of the top location influences how the product is layered.

Q. Are there any dark clouds on the horizon?

A. It’s not all perfect now and there are definitely issues to be aware of. If already we have local terror insurers in some countries and the London market providing more global coverage, a new development is international insurance programmes including local policies. But just as in property and many other standard covers there are issues with compliance with such programmes, this is now becoming an issue in terrorism cover. As such, companies need the right partner and right now there are very few insurers able to issue good local policies in a number of countries where they are a necessity for firms who want to operate there.

This is something that really needs to be looked at. We need to develop standard cover that can meet diverse local conditions, and that just does not exist at the moment. The market is currently very small.

Q. Are there issues for supply chain risk?

A. Yes, there are potential interdependence issues. When terrorists attack a plant, that may have an effect on another plant that it is supplying with obvious knock-on. It’s important to realise that if you only have local cover, it may not cover these relationships. Even if you do have a global cover it is very important that you check that these issues are covered in your plan.

Q. How significant is broader political risk for DVS members? How is this developing?

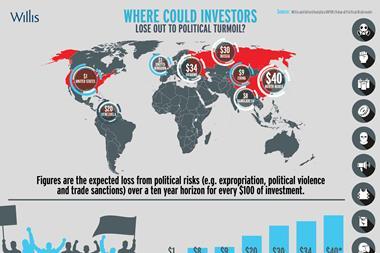

A. It is a significant risk in many markets and insurers are developing products to meet the risk. These cover all the issues of expropriation, nationalisation, lack of currency convertibility, licences. In many ways you could think of terrorism cover as an aspect of political risk, but in reality it is related but separate. When we talk about terror, we are talking about material damage. Political cover looks at different risks altogether. It’s a lot bigger.

Q. How is globalisation changing DVS members exposure to political risk? How is this developing?

A. In Germany we have had since the beginning of the foundation of our country, a state-backed, state-organised coverage, who provide investment insurance against political risk. As a result, many German companies do not see a need for another solution. But due to the increasingly risky global situation and the fact that German companies are operating more globally and placing not just sales offices abroad, but major manufacturing plants, they are taking a different view.

More and more they are looking at cover, not on a project-by-project basis, but on a genuinely global level. This is even more important in a world that seems to be becoming more unpredictable. I had a client asking only last year about insurance for working in Russia. In the end they declined to buy it because of what they saw as the high deductibles and low exposure. That has of course all changed now, and events in Ukraine and elsewhere have made companies think: what about other East European countries? Should we get cover now?

Q. Do you think German businesses take these risks seriously enough? What more could they be doing?

Yes they do, and they have for some time. Before a company invests a lot of money overseas, of course they look at the risks. But what has changed is that companies realise that the situation is changing all the time, and that it can change rapidly and unpredictably.

Q. Is the market responding to businesses’ needs?

A. There is good capacity in London and Germany. The size of the premium depends on the country and the length of the term.

Q. How do underwriters approach these risks? What lessons are there?

A. They look at the risks in great detail, they even look at joint venture contracts and licence contracts. Not just to evaluate the risks, but to see the possibilities of recourse if there is a kind of nationalisation or expropriation, and they had to pay a client, they want to know if they can get their money back.

No comments yet