Firms urged to embrace interdependent risks

The Industrial Revolution has cast a long shadow. Until the last few years, most risk management could still be based in principle on protecting the factory – the hub of production – and not be overly concerned with much else.

This assumption has largely held through post-millennium events such as floods, earthquakes and revolutions that wrought widespread havoc on companies with global links. But in the wake of those disasters, a new and far more elusive threat has emerged – that of the increasingly interconnected nature of risk.

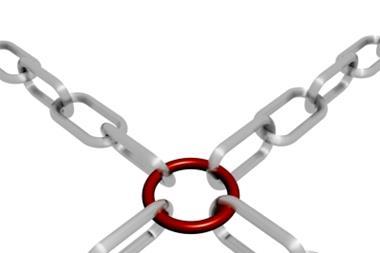

Students of the phenomenon argue that no international business will be able to successfully negotiate this spider’s web of risk unless it recognises the nature of it and takes specific measures to embrace interconnectedness for its own ends.

Daniel Stander, a managing director at catastrophe specialist Risk Management Solutions, sums it up: “In an era of relentless globalisation, as risks become more interconnected and more mobile, the best companies are outmanoeuvring their competitors by investing in innovations around this whole issue of interconnected risk.”

The key word there may be ‘mobile’. There are too few companies, he suggests, who fully comprehend the nature of the world in which they operate. And that’s one where risks are in motion. “Mobile risks aren’t located at multiple fixed points,” he explains. “They’re moving along the vectors and nodes. Risk managers need to be expert in understanding how these risks are shifting between fixed points.”

If this sounds a little too theoretical, the interconnectedness of risk can be easily summarised. “There are no local events anymore,” says Stander. “Spatial proximity [nearness to the event] is only a bit player in the total caste of the risk programme.”

Put another way, risk is not confined to fixed locations such as a factory. Instead it spreads in concentric circles.

Another way of describing it is ‘hyper-connectivity’, and it’s a bigger phenomenon than the revolution in telecommunications.

As the Economist Intelligence Unit wrote in its paper in October 2014: “More than a technological trend, hyperconnectivity is a cultural condition to which businesses have no choice other than to adapt.”

Fundamental shift

And it’s a condition that’s coming up fast. The World Economic Forum’s latest survey of global risks – obligatory reading for those charged with protecting their companies – paints a picture of interlocking risks that move up or down the scale in terms of importance and likelihood according to wherever a business is active.

“[Interconnectedness] is a fundamental shift,” summarises Alan Marcus, senior director at the WEF. If not managed, the consequences of interconnectedness are all too obvious.

As Stander says, when the Fukushima tsunami hit Japan’s east coast March 11, 2011, it not only caused a desperate humanitarian disaster but halted production of BMWs in Munich, triggered falls in US Treasury bills, and created shortages in iPads in Australia.

The conclusion? Such was the commercial devastation caused in a world that had grown complacent about the robustness of its supply chains that Fukushima – and similar events – that it triggered a new kind of analytics in risk management: examining interconnected risks.

Over the next few pages, we look at some of the biggest risk events that have triggered this ‘spider’s web’ of interconnected risks. Some of these risk incidents are related to our survey findings (overleaf) and others look at the less known links.

No comments yet