Insurance lawyers hosted a conference looking at the latest risk trends

Earlier this year, AIDA Europe hosted its first conference in Hamburg, under the heading: ‘Insurance and Reinsurance in Europe: New Challenges’. Not surprisingly, emerging risks topped the agenda.

AIDA Europe is the regional grouping of the International Association of Insurance Law, a non-profit-making organisation that brings together lawyers, academics and professionals from the insurance field worldwide. Within the theme of the conference an important topic which was at the centre of attention was: Present and future risks – the latest developments and the next big claims. The speakers and contributors examined future risks and consequences of an increase in claims.

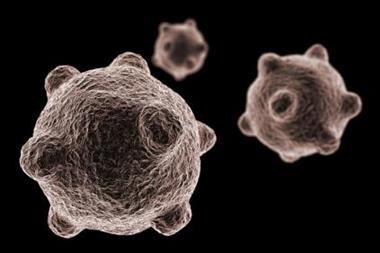

Among the topics under discussion were climate change and the losses incurred as a result. Asbestos was also considered a concern as was a global pandemic. The growing risks associated with chemical exposure were also widely considered, with concern expressed that this issue could have repercussions on the scale of the asbestos problem. Other topics discussed were the increased risks associated with engineering developments and the trend of increasing claims related to nanotechnology.

In the view of some contributors, there will be a greater risk related to identity theft claims as more and more personal data is acquired and stored by the public and private sectors. Recent high-profile examples of lax data security procedures among some government agencies gave these concerns relevance.

Another subject discussed was the consequence of higher population density. Some believe that this will bring an increase in claims, but in others’ view it will bring more business and opportunities to the industry. The industry expanded with the liberalisation of eastern Europe, although this resulted in an increase in directors’ and officers’ risks. The collapse of the sub-prime loan market was also expected to produce an increase in claims.

“

Asbestos was a concern, as was a global pandemic.

Return to common sense?

The UK case of Mason v Satelcom Limited and Another CA 4 June 2008 could herald a return to common sense, according to a Court of Appeal judge.

The case involved Mason (claimant), who was employed by Satelcom (second defendant) to replace a circuit board in a server room occupied by East (defendant). Mason used a ladder he found in the server room. This ladder was too short and Mason fell and damaged his back. The first-instance court initially found Satelcom liable to Mason for negligence and breach of statutory duty. East was also liable as occupier for breach of statutory duty under the Provision and Use of Work Equipment Regulations 1998.

The Court of Appeal (CA), however, found that East, as an occupier but not owner of the ladder, did not have sufficient control over it for the 1998 Regulations to apply and considered such a strict application ‘absurd’. The decision has been welcomed as a return to common sense and can only be good news for companies and their public liability insurers.