Law firm cites climate change, ESG and cyber exclusions as key sources of concern for insurers

Climate change, ESG responsibilities and cyber risks are just some of the key concerns facing the insurance industry in 2023, according to law firm RPC.

Its report draws on the market insights of experienced RPC lawyers with extensive knowledge of the international insurance sector across important industries that drive the global economy.

Simon Laird, global head of Insurance at RPC, says: “Climate change, ESG, cyber and the continuing conflict in Ukraine remain centre stage for the insurance industry, creating both new opportunities for insurers and new challenges from a claims and coverage perspective.

The law firm predicts that 2023 could be a rocky year for estate agents, property managers and rental companies as the economic recession pushes down property prices and increases utility bills.

“The headwinds that the economy is creating will also prove a significant challenge,” continued Laird. “Recessions normally mean more claims against professional advisers. For insurers the challenge is establishing which professions will be most exposed this time around.”

Cyber war exclusions:

The scope of cyber cover was a hot topic for 2022, with Lloyds of London announcing there will no longer be coverage for some state-backed cyberattacks from March 2023.

Alongside its announcement, Lloyds produced four new Lloyd’s Market Association (LMA) clauses for use in cyber policies, which exclude cover for losses incurred due to war and/or due to cyber operations launched during war, in retaliation by specific states, or which cause major detrimental impacts to the functioning of a state.

It remains to be seen whether 2023 is the year in which the scope of the new LMA clauses are tested, notes RPC.

“In the meantime, the market will have to continue balancing the needs of the insurance market in insuring knowable risk, the needs of the commercial sector in managing the risk of cyber threats, and the mutual need to keep premiums competitive and manageable.”

Sustainable insurance and Net Zero:

To tackle the effects of climate change and growing importance of ESG, insurers are refining their business offerings by expanding into the sustainable insurance market. As the pressure increases to adopt renewable energy sources, insurers will need to adjust their underwriting portfolios to reflect this transition.

In an innovative move, Marsh launched the world’s first insurance for hydrogen projects in August 2022. “As the product gains momentum, it will be interesting to see its impact on the insurance market and if other insurers will join this sector and announce their own initiatives,” noted RPC.

“In the meantime, claims teams will need to remain agile to respond to the possibility of new types of exposures from this developing area.”

D&O claims relating to ESG and the recession:

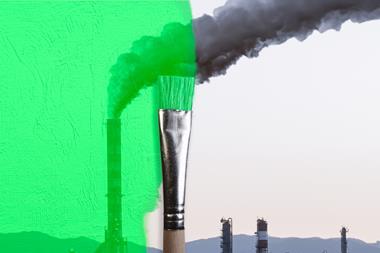

With promises of being ESG responsible, corporates and their directors will come under increasing scrutiny, with allegations pertaining to alleged “greenwashing” gaining increasing prominence.

The “S” of ESG will is gaining increasing prominence with companies now required to disclose statistics on the representation of women and ethnic minorities on their boards and executive management. Subject to how companies respond to the new requirement, disclosure related litigation could ensue.

As company insolvencies increase in the economic downturn directors and officers could face an increase in claims brought against them, particularly as litigation funding continues to be readily available.

Construction claims:

Companies going under, general interest rate rises, supply chain pressures and demand for labour are the highest risk for construction sector insurers in 2023. Delays or cessation of projects due to these factors could see a rise in disputes and losses.

Health and safety:

The latest statistics published by the UK’s Health and Safety Executive show 2.1 million employees reported work-related illness in 2021/22, of which 53% suffered stress, depression or anxiety.

It is only a matter of time before prosecutions for causing work-related stress occur against organisations that have not prioritised mental health and supporting their workforce, warns RPC.

“There have already been cases in France where a spate of suicides among employees led to a prosecution against the employer, France Telecom.”

Businesses and insurers will also need to consider a raft of new legislation in 2023.

These include the Protect Duty legislation, brought in following the bombing at an Ariana Grande’s concert at the Manchester Arena in May 2017, which will impose a legal requirement to formally assess terrorism risk and put measures in place to reduce that risk; and the Fire Safety (England) Regulations 2022, following the Grenfell tragedy, which is expected to come into force in January 2023.

No comments yet