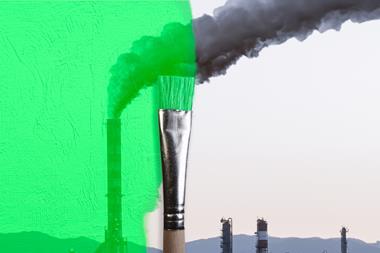

When it comes to embedding climate threats into organisational risk management strategies, progress is being made. Slowly. But, as our 2024 climate change survey finds, the fight for resources continues.

This article is part of our special report on Climate Change, produced in collaboration with Zurich. You can download the full report, which includes analysis, case studies, features, and the results from our research here.

Are risk managers adequately prepared and supported – internally and externally – to manage climate - and sustainability-related risks?

The short answer, perhaps unsurprisingly, is there is still plenty of room for improvement, despite progress in some areas.

This is according to the data from this year’s global climate risk survey. The main stumbling block to moving the dial? A lack of financial investment, according to many respondents.

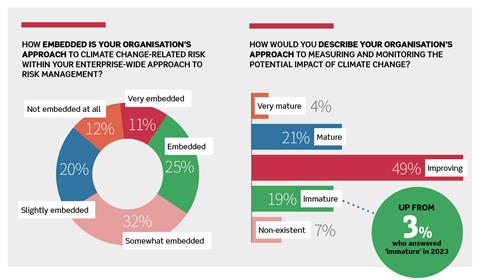

This hasn’t stalled all efforts, though. Compared to 2023, risk managers are making some strides in embedding and therefore ‘operationalising’ their approaches to climate risk. For example, 11% say their approaches are ‘very embedded’ versus only 3% who were able to make this claim in 2023.

INVESTMENT AN UPHILL BATTLE

But these strides are still overshadowed by the drawbacks. For instance, the way in which the global risk management community rated their approaches to managing and monitoring the potential impact of climate change points to significant challenges.

While it is heartening that the number of respondents describing theirs as ‘Very mature’ went up from 0% to 4% and ‘Mature’ skipped from 16% to 21%, nearly half of respondents – 48.5% – still said their measuring and monitoring approach was ‘improving’. This is, at least, down from 69% in 2023. The ‘immature’ category has also increased significantly from 3% in 2023 to 19% in 2024.

“Any organisation, especially those facing financial constraints, may struggle to allocate sufficient resources to these areas.”

The biggest stumbling block is likely to be resource constraints, says Annacel Natividad, chief risk officer for Aboitiz and president of PARIMA. “This is something I am experiencing now”, she says. “Addressing climate risk requires significant investment in new technologies, whether that is in updating legacy equipment or transitioning to biomass-friendly energy.

“This is on top of any infrastructure or process you may need to implement within the organisation.” She adds: “Any organisation, especially those facing financial constraints, may struggle to allocate sufficient resources to these areas.”

THIS IS A PRIORITY

A lack of immediate incentives will also add to any existing challenge in gaining financial support, says Natividad. “Organisations may prioritise shortterm financial performance over long-term climate risk management, especially if the immediate consequences of climate risk are not yet evident.”

This is a disappointing and sad fact, says Franck Baron, group deputy director of risk management & insurance at International SOS and president of IFRIMA (the International Federation of Risk and Insurance Management).

For Baron, the climate and sustainability agenda is actually an opportunity to extend the longevity of a risk manager’s role and value

“The climate agenda provides risk managers with the long-term horizon that we are all fighting for,” he says. “It puts them in the position to consider, ‘how can I make a difference? How can I help to protect, secure and sustain my business and operating model over the next 10 to 15 years?’”

“The climate agenda provides risk managers with the long-term horizon that we are all fighting for”

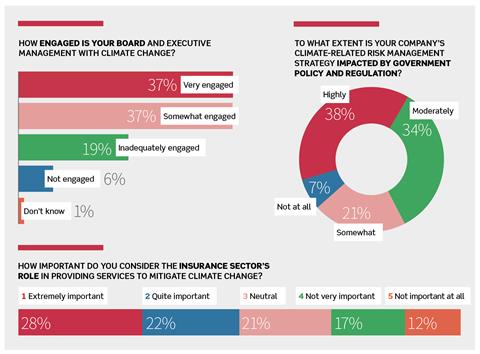

And carving out this ‘longer-term horizon’ role, may not be as tricky as we might initially think, if we consider the data. Board engagement on this topic appears promising, with an even distribution of 36.5% across two categories – ‘very engaged’ and ‘somewhat engaged’.

And while the ‘inadequately engaged’ category makes up a fair proportion of the respondents at 19%, it is still proportionately smaller than the engaged categories combined (73%).

“This data is encouraging,” says Natividad. “I would view this as increased board involvement.” She adds: “In many organisations, climate risk is now considered a strategic priority, and boards are more frequently discussing climate risk as part of their oversight responsibilities.”

MAINTAINING THE PRESSURE

And in terms of the risk management opportunity, Natividad says: “There’s a growing trend of boards seeking members with expertise in climate science, sustainability or even risk management.”

This is particularly the case among publicly listed organisations and those directly impacted by climate risks such as energy and power companies. But support, incentives and pressure from external service providers are also needed to create and maintain a strong corporate imperative around the climate agenda.

Corporate financing options from investment banks for example, “provide incentives to invest in sustainable or green financing”, says Natividad. Then there is regulatory pressure, most notably in current reporting disclosures such as EU Corporate Sustainability Reporting Directive or IFRS 1 and 2, and more.

“Pressure from external stakeholders is good for corporates”

In fact, the majority of respondents say that their company’s climate-related risk management strategy is impacted by government policy and regulation at varying degrees – highly (34%), moderately (38%) or somewhat (21%), versus the minority of 7% who state ‘not at all’.

“Pressure from external stakeholders is good for corporates,” says Baron. “But the commercial insurance market isn’t so good at instilling social pressure.”

This can be linked to a lack of proactive information sharing, explains Baron. “That is to say, some insurers fail to tell clients that the price of their risk is different now,” he says.

INSURANCE HAS WORK TO DO

So how do respondents view insurers in terms of providing services to help mitigate climate change?

On a five-point scale – where 1 represents ‘Extremely important’ and 5 represents ‘Not important at all’ – over one-quarter (28%) ranked insurers as ‘Extremely important’. The scores decline at each point down the scale, indicating overall positive sentiment towards insurer’s support.

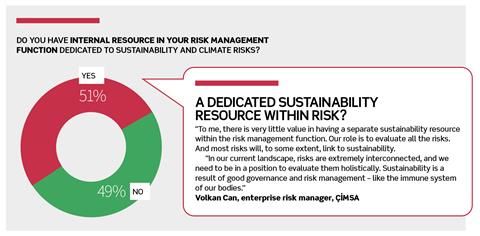

This is still not enough, says Volkan Can, enterprise risk manager at leading cement producer, ÇIMSA, based in Turkey. “This score for ‘extremely important’ should be higher,” he says.

“We are directly affected in my company by severe weather conditions. Our insurance premiums rocket as a result. This will be the case for many organisations like mine that are directly impacted by extreme weather conditions.”

Unfortunately, what’s on the market appears uninspiring. “The insurance sector should find new products for ESG,” Can adds. “The lack of innovation might be the reason why respondents couldn’t relate their score to 1.”

“We are directly affected in my company by severe weather conditions. Our insurance premiums rocket as a result.”

This sentiment is echoed by Aboitiz’s Natividad. Where risk innovation is concerned, modelling and tools can help insurers price more accurately based on an individual organisation’s risk profile, she explains. And this should take into account any internal risk-reducing initiatives – and not just model prices based on the country’s risk.

She says: “I always challenge our insurers because they play a crucial role in mitigating climate risk by leveraging their risk management expertise.”

There is also the social responsibility. Similarly to the banks, insurers can do more, Natividad says, by “incentivising organisations to take risk-reducing behaviours like investing in resilient infrastructure, adopting sustainable practices and offering premium discounts or other benefits to insured parties who implement risk reducing measures”.

DEEP IMPACT

The pressure on all parties isn’t going away anytime soon, according to the global risk management community.

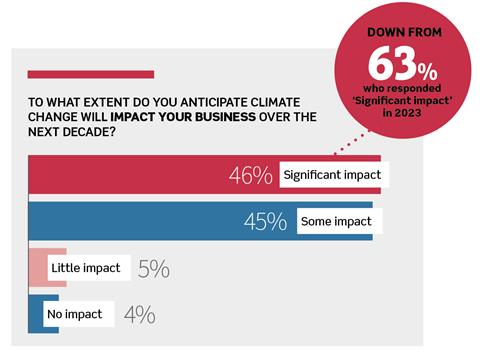

When asked, “To what extent do you anticipate climate change will impact your business over the next decade?”, almost 100% of respondents fell between two categories: ‘Significant impact’ (46%) and ‘Some impact’ (45%).

If ever there was a time to dial up the pressure and the innovation – internally and externally – that time would be now.

METHODOLOGY

Now in its fifth year, this online survey asked corporate risk managers from all over the world a series of questions about how their organisations are mitigating climate change risks. A cross-section of StrategicRISK readers were invited to take part anonymously across a broad range of industry sectors.

103 people participated, with 44% based in Europe, 32% in Asia Pacifi c, 15% in the Americas, and 9% in the Middle East and Africa. For every completed survey, StrategicRISK has donated €10 to The International Federation of Red Cross and Red Crescent Societies’ Disaster Relief Emergency Fund, a vital humanitarian fund supporting disaster relief efforts. Zurich Commercial Insurance and the Z Zurich Foundation have both donated the equivalent amount.

No comments yet