An ‘onslaught of climate regulations’ could lead ‘to less disclosure and more green hushing’, says risk management association

Businesses of all sizes are still struggling to come to terms with the fast-moving requirements around climate change strategy disclosures and the steps that need to be taken to reduce their carbon footprints.

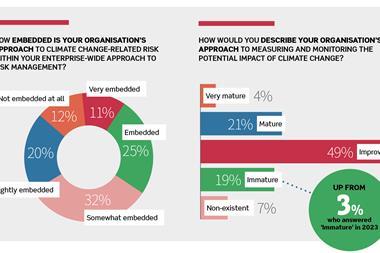

Risk management trade body the Association of Insurance and Risk Managers in Industry and Commerce (Airmic) polled its entire membership and found that one in five believe their organisations are only prepared for climate-related regulations to a minimal extent, or not at all.

Aside from the wide range of organisations which do not currently fall under the scope of regulated climate reporting, risk managers said the reliability of climate data from their supply chains and conflicting regulations and policies in different jurisdictions continue to provide challenges.

What does it mean for businesses?

In January 2023, the Corporate Sustainability Reporting Directive (CSRD) came into force in the European Union.

It modernises and strengthens the rules concerning the social and environmental information that companies have to report. Starting this year, non-EU companies with a net turnover of over EUR 150 million in the EU market will also have to report.

However, an article by Herbert Smith Freehills this year cautioned that with the recent rise in climate litigation, disclosure issues related to climate risks are now one of the two key exposures for directors and officers.

Hoe-Yeong Loke, head of research at Airmic, said: “The results point to a potential divergence between corporations with large ESG teams and smaller organisations which nevertheless fall under the scope of regulated climate reporting, in terms of preparedness.

“Organisations are also receiving multiple requests for climate data – from regulators, investors, insurers and activists, for instance – which can be onerous to respond to if they lack a large team and or additional systems to capture the data requested.”

Leigh-Anne Slade, head of media, communications and interest groups at Airmic, added: “There is a sense among risk professionals that the onslaught of climate regulations today could have the opposite effect of leading to less disclosure and more ‘green hushing’ – where an organisation makes a deliberate decision to keep quiet about its climate strategies.”

Beware over-reliance on carbon credits

Last week, broker Gallagher revealed that 63% of all sustainability targets set by large businesses in the UK will be achieved by the purchase of carbon credits, with companies planning to spend £20m on average to do so.

Carbon credits – also known as carbon offsets – are permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gases. This limit is reduced periodically.

Gallagher found that 27% of large UK businesses do not have a backup plan in case their carbon credits fail.

How to tackle the threats

Companies recognise they are not fully aware of what they are required to deliver when it comes to climate linked reporting. They admit to being perplexed and are looking to brokers and insurers for guidance and support.

Some market commentators fears that companies will be faced with new liabilities in light of new reporting requirements, which businesses could quite simply be unaware of as regulatory systems continue to evolve and corporate processes fail to keep pace.

And while organisations’ intentions to mitigate the impact of climate change are clear, the pathway to understanding how to achieve this continues to be opaque.

Julia Graham, CEO of Airmic, said: “One of the key challenges today in making the climate transition relates to how an organisation can accurately measure its Scope 3 emissions – emissions that are the result of activities from the organisation’s value chain.

“Nevertheless, risk professionals should consider what climate data is material to their business, to determine the metrics that would drive their journey towards greater sustainability.”

Airmic is working with professional services firm KPMG and the Lloyd’s Market Association (LMA) to examine how the insurance sector can better support organisations with the transition to net-zero carbon dioxide emissions.

No comments yet