Organisations must develop agile and adaptive strategies to tackle climate risk. Steve Greenstein, CBCI, Fusion Risk Management’s go-to-market SME, explains how.

The escalating impacts of climate change – from heatwaves and forest fires to flooding and tornadoes – highlight the significant risks that organisations face today.

These risks include immediate and long-term threats such as regulatory pressures as well as damage to brands and reputations.

To navigate these challenges with resilience and foresight, organisations must develop agile and adaptive strategies, engage with industry experts, and integrate innovative technologies into their programs.

Strategic approaches to climate change challenges

Strategic planning and a proactive approach are essential for managing the adverse impacts of climate change on physical, operational, and technological infrastructure.

Organisations must develop a culture of resiliency, safeguarding their core assets and ensuring continuity of critical operations.

Collaboration on policy, legal, technology, and market changes is also crucial for addressing climate change mitigation and adaptation.

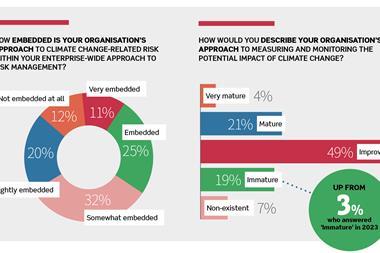

In addition, establishing a robust process for identifying, measuring, monitoring, and controlling financial and operational risks linked to climate change is vital, with board oversight ensuring comprehensive efforts.

Protecting mission-critical operations from disruptions

Building dynamic and agile business continuity and operational resilience programs is essential for safeguarding organisations’ critical operations and ensuring long-term sustainability.

Risk practitioners must identify and map crucial business processes, services, technology assets, vendors, and key personnel to reduce the impact of disruptions.

Meticulous documentation and analysis of critical processes enables the development of effective contingency plans and mitigation strategies, ensuring the continuity of mission-critical operations.

Mapping remote workforce vulnerabilities

In an era of distributed workforces, organiaations must consider the unique risks that remote employees may face.

Mapping employees to their respective business processes and services allows for the identification of key personnel whose absence could disrupt critical operations.

This awareness enables comprehensive contingency plans, such as cross-training employees and providing backup power solutions, allowing organisations to maintain operational continuity even when natural disasters impact remote employees.

Futureproofing against climate change

Conducting thorough risk assessments for existing and prospective facilities is essential for effective business continuity and operational resilience.

Evaluating natural disaster threats, their likelihood, and their projected impact on each site, including third-party vendors and data centers, allows for informed decisions about site selection, facility hardening, and disaster recovery planning.

To enhance operational resilience in the face of climate change and nature-related risks, organisations should integrate innovative technologies, engage with industry experts, and foster a resilient organisational culture.

Strategic planning, robust risk assessments, and meticulous documentation of critical processes are also vital in achieving resilience.

By prioritizing these efforts, organisations will be better equipped to protect their core operations, ensure business continuity, and navigate the evolving landscape of climate-related challenges.

Financial authorities are at different stages of evaluation

Financial authorities, in particular, are also recognising the relevance of biodiversity loss and other nature-related risks as financial risks.

Approaches vary, with some authorities concluding that there is a material financial risk, while others are monitoring international work on the issue.

Nature-related risks are categorised into physical and transition risks, like climate-related financial risk analyses. However, analytical work faces data and modeling challenges.

Financial institutions face significant exposures to physical risk, but further development is needed to translate estimates of financial exposures into measures of risk. Regulatory and supervisory work on nature-related risks is at an early stage globally, with approaches differing across jurisdictions and institutions.

However, several authorities have already initiated regulatory and supervisory initiatives. Recognising the need for expertise, capacity-building initiatives are underway to address nature-related risks.

By integrating these insights, organisations can proactively mitigate risks, seize new opportunities for growth and sustainability, and future-proof against the unpredictable impacts of climate change and nature-related risks.

No comments yet