As the journey to net-zero continues apace, it is creating unique and emerging risks for organisations. Here are the key threats that risk managers need to be aware of, and why collaboration is the key to solving them

In association with AXA XL

As companies move towards net-zero, new risks emerge, which require a comprehensive approach to risk management and mitigation.

Key threats include those created by new technologies, supply chain disruptions, and regulatory complexity.

In the Asia-Pacific region, country risk is a significant challenge, creating specific and unique risks for businesses.

Guillaume Parard, head of energy & construction, APAC and Europe at AXA XL explains: “Investors exercise caution in regions with political instability or uncertainty. This cautious approach to investment can hinder the pace and scale of energy transition initiatives, which could impact progress in the APAC region.”

Inadequacies within certain regulatory regimes in Asia-Pacific may further impede the development of renewable energy projects and Parard cautions that the transition is susceptible to technology risks and supply chain disruptions, which businesses must manage effectively to ensure a successful transition.

He says: “The rapid pace of transition to net-zero requires grids to be significantly modified to accommodate the increasing integration of renewable energy sources. Grid modification is critical for the transition to net-zero, yet the evolving nature of this transformation presents additional complexities and potential risks that companies need to navigate effectively.”

Understanding the new threat landscape

As the journey to net-zero continues apace, businesses are facing significant technological and operational risks. This is particularly true when venturing into uncharted territory by testing new technologies in markets where they have not been previously deployed.

Andrew Vigar, head of client and distribution Asia, at AXA XL says: “The development of offshore wind projects across Asia presents a prime example of the technological and operational risks associated with pioneering renewable energy solutions in new markets.”

“These evolving risks have the potential to impact the progress towards achieving net-zero emissions, which could potentially impair or slow down the overall transition.”

In addition to these core risks, the transition to net-zero creates future risks such as supply chain disruptions, which could stem from the sparse availability of vessels for offshore wind farms or an undersupply of critical materials due to geopolitical events.

Vigar adds: “The scalability of offshore wind projects in Asia amplifies the significance of ensuring a resilient and reliable supply chain to support the expansion of renewable energy infrastructure in the region. These evolving risks have the potential to impact the progress towards achieving net-zero emissions, which could potentially impair or slow down the overall transition.”

Barriers to risk management

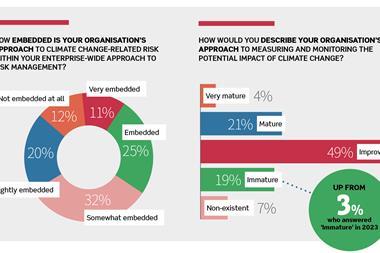

The challenges that risk managers face when managing energy transition risks are multi-faceted.

One key issue is the scarcity of actuarial data for informed risk assessment, given the emerging nature of these risks and the limited data available to make informed decisions.

Jack Hullah, underwriting manager, political risk, credit & bond at AXA XL says that the evolving regulatory frameworks and energy transition pathways add to the complexity facing risk managers.

“The dynamic nature of these uncertainties can present additional complexities and risks that need to be carefully assessed”

He explains: “Certain regulatory frameworks are still under development and may not provide sufficient guidance on how to address new and emerging risks, which requires risk managers to adapt their strategies in real time to align with revisions to standards and regulations.”

Looking at APAC specifically, one significant challenge is the ability to develop a bankable project - particularly in the face of economic and political uncertainties across the region.

Hullah adds: “The dynamic nature of these uncertainties can present additional complexities and risks that need to be carefully assessed and managed to ensure the success of energy transition projects.”

A strategic approach

Risk managers have a range of strategies they can use to ensure effective risk management and resilience.

For instance, carrying out a scenario analysis allows risk managers to assess the potential impact of diverse energy transition pathways on their operations, supply chain, and financial performance.

Such analysis provides valuable insights for strategic decision-making and risk mitigation.

Parard says: “Diversifying energy sources and supply chains is another crucial aspect of risk management in energy transition. By embracing a diversified approach, organisations can mitigate the risks associated with the transition to renewable energy and evolving market dynamics by supporting adaptability and reducing vulnerability.”

The role of insurance

The emergence of new risks may introduce exposures that current regulatory frameworks do not adequately address - leaving both the insured and insurers in a state of uncertainty.

For instance, the potential consequences of a CO2 storage leak may raise concerns about third-party risks and legal actions for environmental damage.

Vigar says: “As risk managers navigate these challenges, it is essential for them to collaborate closely with industry stakeholders and leverage the expertise of insurers to develop tailored risk management strategies that address the complexities of the energy transition journey.

“Suitable insurance programmes can be leveraged to provide coverage for the benefit of sponsors and other invested parties. This collaborative risk management approach not only mitigates the financial impact but also enhances the organisation’s overall resilience in the face of complex risks associated with energy transition.”

“A collaborative approach not only enhances the effectiveness of risk management strategies but also paves the way for a positive, lasting and meaningful impact on current and future generations.”

“A collaborative approach not only enhances the effectiveness of risk management strategies but also paves the way for a positive, lasting and meaningful impact on current and future generations.”

However, it’s important to recognise that the transition journey towards sustainable energy solutions often creates unique and emerging risks that may not be fully captured by traditional insurance products. Instead, organisations, risk managers, and insurers must work together to collectively navigate uncharted waters.

Achieving this, means fostering an open dialogue and knowledge exchange. By sharing insights, challenges, and ambitions, businesses and insurers in APAC can collectively contribute to the development of innovative risk management and insurance solutions

Parard concludes: “Insurers need to adapt to this market reality by developing and refining product coverage that aligns with the specific needs of businesses in the energy transition space.

“Such adaptation involves addressing the challenges associated with limited actuarial data, loss history, and pricing validity for emerging risks. This is a work in progress for the insurers and needs to be managed carefully and methodically.

“A collaborative approach not only enhances the effectiveness of risk management strategies but also paves the way for a positive, lasting and meaningful impact on current and future generations.”