When it comes to risk management, businesses must take the long view and invest in resilience-building measures, says FM Global’s operations manager, Bill Bradshaw

This article also appeared in our sister publication Insurance Times

With the growing impacts of climate change on the insurance sector showing no signs of slowing, the industry is in need of some innovative thinking.

In a Swiss Re Sigma report published last year – the reinsurer found that the insured global costs of natural catastrophes in 2022 exceeded $100bn (£82bn) for the second consecutive year.

This revelation was also the continuation of a trend that saw on average 5% and 7% year-on-year increases in insured losses over the past three decades.

And while increasing insurance penetration to better protect customers and society as a whole is laudable, the insurance sector simply cannot absorb the costs of a changing climate without amending its own model.

Indeed, many insurers are exiting high-risk areas because of the costs of climate-related events.

According to a Bloomberg Intelligence report issued today, more than half of the top 20 global (re)insurers cut their natural catastrophe exposure at the January 1 2023 renewals.

“Insurance alone is not enough,” to respond to the rising costs of climate change, says Bill Bradshaw, operations manager at mutual insurer FM Global.

“From a flood or wind perspective, there a lots of things you can do to manage those exposures to make sure that facilities are in the best position possible

“There has to be some element of risk mitigation running alongside of that.”

As a mutual, FM Global is owned by its policy-holders and distributes its profits to them via dividend distributions or premium savings. But, having identified climate change as a significant, growing risk, it decided to act.

Bradshaw explains: “We took the decision a couple of years ago to take a certain amount of our surplus and give it back to our clients in the form of a resilience credit. In 2023, we gave £278m ($350m) to clients to reinvest back into resilience measures for their business.

“We can’t change the fact that a client is in a flood-zone, but we can take some control over stuff that is within our remit. Particularly from a flood or wind perspective, there a lots of things you can do to manage those exposures to make sure that facilities are in the best position possible, once normality has resumed, to begin producing and adding value to customers.”

Building for the future

The insurer’s mutual model is particularly well-placed for the work of building resilience to climate-related perils.

Bradshaw explains: “As a mutual company, we can take a really long-term view of risk – we don’t need to knee-jerk whenever something happens in the markets.

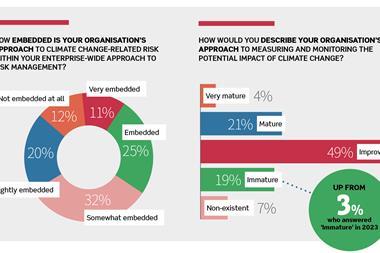

“The reality is that these risk mitigation efforts take a while to think about, prioritise and ultimately implement. But what is important as insurers, as organisations or as UK PLC in general, is that we have the data that allows us to make really good decisions and look for innovative solutions.”

Data is particularly important where building resilience is concerned because it allows insurers to go to their clients and present models that demonstrate the long-term value of building resilience.

“Good data equals good decisions, equals successful businesses”

FM Global, for example, underwrites risks on a location basis by sending risk engineers to sites to collect data, make an assessment, and suggest appropriate resilience measures.

Bradshaw says: “Good data equals good decisions, equals successful businesses. We know resilient businesses are successful. We are able to go to clients and say ’this is your exposure now, this it will be in the future and, if you were to spend and invest this money [into resilience measures now], this is what it would do to your risk long term’.

”Companies can also report that as an actionable item that they’ve taken to mitigate climate risk, now that there’s an expectation on businesses to understand and have strategies in place.”

Societal impact

Data has a very real operational impact for insureds, as it allows them to make business-critical decisions around how to protect themselves most effectively from disasters.

FM Global serves commercial clients and, in many cases, making sure a business is back up and running promptly can have a positive societal impact too.

Bradshaw says: “Ultimately, we all suffer in society if a pharmaceutical plant stops functioning, if a food factories or power generation plants close down – so there’s a collective responsibility to address some of these things.”

Data has a very real operational impact for insureds, as it allows them to make business-critical decisions

He adds that, by ploughing profits back into providing resilience credits for FM Global’s clients, the mutual aims to create “a circle of resilience”.

“If our customers take control of their risks, we can see less losses together, which means we can generate more profit and provide more resilience funding,” he says.

“That’s a big part of what our mutual model is all about – investing in clients and good decisions to go on a journey together that will ultimately help those clients be successful in their business.”

Source

No comments yet