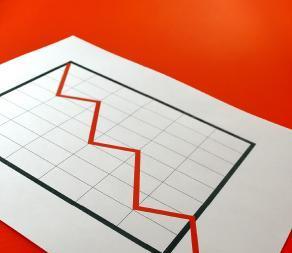

Credit insurers are expected to post lower net income in 2008

Fitch Ratings says it remains cautious on the credit insurance industry amid concerns that the recent financial turmoil could lead to more bankruptcies, in turn affecting credit insurers' underwriting performance.

Credit insurers underwrite corporate trade receivables, resulting in a high correlation between underwriting performance and corporate bankruptcies.

‘Corporates face a double-whammy of slowing profits as the world economy cools and of diminishing funding from banks. Credit insurers are expected to post lower net income in 2008 compared to the peak seen in 2007,’ says Marc-Philippe Juilliard, senior director in Fitch's Insurance team.

‘But given the current estimation of global bankruptcies in 2008, the drop in net income should be less pronounced than that seen in 2002. This can also be attributed to lower expense ratios and more sophisticated risk management tools developed by credit insurance companies.’

Over the period 2000-2007 the three main credit insurers posted their worst net income results in 2002 after the financial crisis in 2001. Atradius posted a loss of EUR 75.1m, Coface, EUR 18.8m, and Euler Hermes EUR 51.2m. These net results are to be compared with the record net income posted in 2007: Atradius (EUR 164.2m), Coface (EUR 163.5m) and Euler Hermes (EUR 407m).

The number of corporate insolvencies in 2008 is expected to rise globally: the Euler Hermes Global Insolvency Index is estimated to increase 15% in 2008 after an increase of 6% in 2007. Nevertheless, the level of corporate defaults is predicted by both Coface and Euler Hermes to remain below the highs witnessed in 2001 and 2002.

However, certain countries (US, UK, Spain and Italy) and sectors (construction and retail) are expected to be more affected than others.

H108 results of the three main credit insurers showed their technical profitability was hit by an increase in claims frequencies on trade receivables. Loss ratios revealed the magnitude of the deterioration: Atradius (H108: 69% versus H107: 64%), Coface (55% versus 46%), Euler Hermes (64% versus 46%). The impact was, however, manageable given the intrinsic profitability of the business: credit insurers have managed to post positive technical results despite deterioration in underwriting performance. This is due to the very short-tail nature of the business underwritten by credit insurers, together with the prompt application of different risk measures to limit the effect of the deteriorating macro-economic situation on their results. Moreover, investment performance contributed positively to the bottom line results, given the companies' rather short-term conservative portfolios with little or no subprime exposure.

Atradius, Coface and Euler Hermes together control more than 90% in the global credit insurance market.

No comments yet