Cybercrime, disruptive technology and pricing are the top three most dangerous risks, according to a new Willis Towers Watson survey of more than 100 insurance industry executives

For the fourth year, Willis Towers Watson has asked insurance executives about what they see as the most dangerous risks to their business. After several years of stable responses, our latest poll shows significant shifts in the risks that are most concerning. Five of last year’s top 10 most dangerous risks have dropped to a lower (and in some cases, much lower) ranking and five previously lower ranked risks have taken their place.

Risks typically fall in rankings like this due to high levels of concern and awareness failing to produce any actual problems or losses, with concern fading as a consequence. Similarly, new risks climb in the rankings because of increasing awareness associated with problems or losses or fear that they will soon produce problems or losses. While we ask about “danger” what we often get is more related to “fear.”

The top 10 most dangerous risks for 2020 chosen by the 101 insurance executives who answered our poll are:

1. Cybersecurity and cybercrime (up from two in 2019)

Insurers have more to worry about regarding cybercrime than other businesses. In addition to the usual potential for direct attacks to their business, insurers also may have to pay for losses experienced by policyholders. In some cases, the coverage for cybercrime-related losses falls under more general types of insurance coverage that may not have been anticipated when the insurance policies were written.

2. Disruptive technology (up from 17 in 2019)

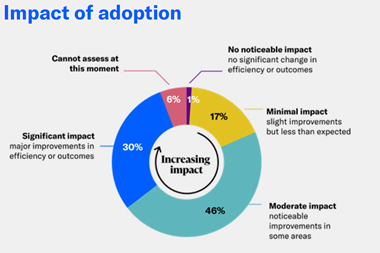

For several years, industry observers have expected tech giants to make incursions into the insurance market. Beginning in 2018 and mushrooming in 2019, we have seen more insurtech offerings for insurance. Insurers need to decide which of these innovations to adopt and which to pass up — a decision fraught with danger.

3. Pricing and product line profit (same rank as 2019)

The concerns about legislation and regulatory risk, interest rates and natural catastrophes add up to intense pressure on profits.

4. Legislative and regulatory (up from six in 2019)

While there are major changes being made to regulations at a federal level that are typically thought to be in favour of businesses, insurers generally operate under state laws and regulations, which for the most part have not changed as much. The law of unintended consequences may bring greater problems to insurers under this mixed environment.

5. IT/systems and tech gap (down from four in 2019 and two in 2018)

Still a high concern, but slowly drifting lower. The next concern is a jump to a completely different type of technology. Insurers are concerned whether the need to bring along legacy business will doom them to lose out in competition to the newest tech driven startups.

6. Interest rate change (up sharply from 26 in 2019)

A little more than a year ago, interest rates looked like they were going to continue to gradually head upwards to levels that would make it easier financially for insurers to run businesses where they hold other people’s money, sometimes for long periods of time. During 2019, that trend reversed, and interest rates ended the 2019 a full percent or more lower than they started and almost 1.5% lower than the late 2018 peak.

7. Competition (down from five in 2019)

Insurance industry growth in total tracks well with nominal GDP growth over time, but there are winners and losers. The top 50% of companies have been growing at twice the GDP growth rate on the average, while the bottom 50% of companies have had near zero average annual growth.

8. Natural catastrophe (up sharply from 28 in 2019)

Recently, we reported that insured losses from natural catastrophes in 2019 were down by 33% from 2018, which was down 44% from 2017. One might think that this very favourable trend might lead to optimism about natural catastrophes but instead, concerns remain very high.

9. Climate change (up very sharply from 53 in 2019)

Many insurance industry observers have said that climate change has a very long-term horizon, while insurance works on a one-year-at-a-time basis. The sharp rise in perceived danger from climate change indicates that many in the insurance industry believe that with evidence like the wildfires in Australia and California, that latency period has passed.

10. Emerging risks (up from 15 in 2019)

This means people in the industry believe that “we don’t know what, but something else is likely to hit us hard.” It is an indication that there is a feeling of ill-defined doom.

Dave Ingram, Head of Willis Re ERM Advisory

No comments yet