Agents and brokers must adapt to their customer changing needs says Swiss Re

Technology is quietly changing the way insurers and consumers interact according to Swiss Re’s latest sigma study, “Digital distribution in insurance: a quiet revolution”.

Based on extensive analysis of research material for different countries, the study shows that the internet and mobile devices are empowering consumers. Clients can review and purchase insurance policies without relying solely on the services of intermediaries.

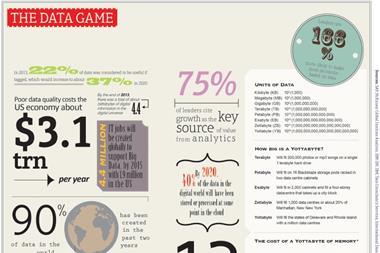

Meanwhile, developments in Big Data are facilitating access to a rich source of data on customers, which insurers can use to enhance sales and marketing strategies. Digital transformation can help insurers become more consumer-centric said the reinsurer.

A quiet revolution

“A quiet revolution is underway,” said Kurt Karl, Swiss Re’s chief economist. In many countries, the share of premiums accounted for by online sales is still small, but it is rising. “The statistics on e-commerce insurance mask the profound effect new technologies are having on the distribution process,” he said.

The survey indicates consumers are increasingly researching online and that the internet has become a trusted source of advice for insurance. Aggregator or price comparison websites (PCWs), as well as social media, are playing a growing role in the pre-sales process. Ginger Turner, co-author of the study said: “With mobile and telematics technology, consumers can now interact with their insurance provider anytime and anywhere.”

Moreover, relatively simple insurance products are being sold online more readily. This is most obvious in personal motor and property insurance, especially in developed markets.

According to Swiss Re, insurers have developed advanced capabilities for direct online platforms even in emerging Asia, where most sales occur via intermediaries. Meanwhile, the buying journey for insurance is becoming fragmented across multiple touch-points.

Not all insurance sectors are at the same stage of this digital transformation and not all will proceed along the same adjustment path and at the same pace. But the reinsurer said that, eventually, customers will be able to arrange most of their insurance needs through remote digital channels.

Importantly, digital transformation does not spell the end of intermediaries.

Technology has spawned new types of intermediaries such as PCWs. Many consumers will continue to value the personal interaction and expert advice of agents and brokers, especially for complex commercial and life and health risks. The challenge for intermediaries and insurers is to adapt their business models to meet the varying needs and preferences of customers.

No comments yet