Risk managers must be highly vigilant, both to spot key emerging threats and evaluate their impact on organisations. Here are the five biggest risks to put on your agenda

Today’s risk managers face a multitude of evolving threats, characterised by geopolitical tensions, technological disruptions, and increasingly severe climate events.

Understanding and mitigating these risks is crucially important for business resilience but doing so means risk managers must be highly vigilant, both to spot the key emerging threats and evaluate their impact on organisations.

Michael Gregory, director of underwriting strategy UK&I at RSA said: “There are really thought-provoking risks out there, and really interesting things going on that are big for society, but if they’re not impacting your business, then you shouldn’t worry too much about them.”

So, what are the key threats that should be on the risk manager’s agenda?

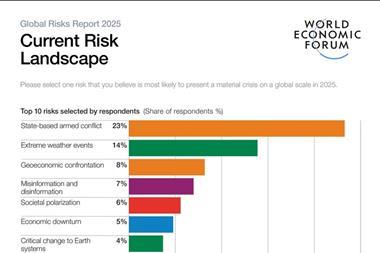

1) Geopolitical tensions

Geopolitical uncertainty remains a pivotal concern for businesses. Meanwhile, the fracturing of global trade into distinct blocs poses challenges for businesses dependent on international supply chains.

Gregory says: “We’ve got the ongoing war in Ukraine, the tensions in the South China Sea which keep bubbling, and other geopolitical hotspots around the world. These can disrupt supply chains, increase energy prices, create political instability, and cause issues with migration. This is not just happening in the areas that are in the mainstream media. It’s happening all around the world.”

Risk managers need to evaluate how these dynamics affect their supply chains and implement robust strategies to ensure resilience across diverse regions. This means managing not just the immediate effects of geopolitical risks, but also the long-term implications. Building resilient supply chains, securing energy resources, and crafting adaptive strategies are all critically important to maintain stability.

2) Economic Uncertainty

Economic uncertainty remains a big concern for risk managers globally as businesses grapple with potential stagflation, high borrowing costs, and varying economic strategies across nations.

Gregory said: “Most areas of the world are comfortable that they’ve got inflation under control, but the big question is have they really [succeeded]? High borrowing costs are impacting business investment and there is potential for recessions. We’re seeing that in the UK, and certainly across areas of Europe, we’ve got countries such as Germany and France who economies are struggling at the moment. The risk of rising tariffs, whether that’s from the US or China or other nations is quite monumental.”

Businesses must reassess their risk management strategies, focusing on the immediate risks with the greatest potential for disruption. Better collaboration with insurance carriers, not just for risk transfer, but for insight, means that risk managers can better insulate against market volatility, ensuring sustained growth.

3) Cybersecurity Threats

Cybersecurity threats have become increasingly sophisticated, posing significant risks to businesses of all sizes. And while technology disruption in the form of artificial intelligence (AI) can unlock opportunities, it also introduces significant challenges.

“Technology has advanced so rapidly,” explains Gregory “and it continues to do so. That creates a huge amount of opportunity, but it could also completely disrupt business models and create risks if the right safeguards are not in place.

“We’re getting to a point where artificial intelligence is scraping artificial intelligence for information. So, where do you draw the line … It’s all well and good to invest in artificial intelligence, but if your people don’t know how to use it properly, the risks are severe.”

From a risk management perspective, the interplay between opportunity and threat requires a high level of understanding. And risk managers must ensure employees are equipped with the knowledge and tools to effectively leverage AI.

From a cybersecurity perspective, maintaining up-to-date prevention methods, employee training and insurance coverage is essential to protect against potential disruptions and financial losses.

4) Climate Change and Extreme Weather

Climate change remains one of the most pressing challenges for this generation, manifesting in increasingly frequent and severe weather events. Recent events such as the wildfires in California and devastating floods across Asia and Europe, demonstrate the severe risks that companies, populations, and governments are facing.

Gregory says: “The advent of extreme weather events is becoming more potent. We’re witnessing phenomena like storm surges, heatwaves, and floods causing unprecedented destruction. The key is to understand what resilience looks like for businesses and communities. Are they in a position to withstand multiple events or significant shifts in climate patterns?”

While many businesses have robust insurance protecting against physical damage due to extreme weather, there is a significant gap in proactive risk mitigation and non-damage business interruption. Risk managers must assess the potential impact of climate on infrastructure and human resources, especially in regions prone to extreme weather.

5) Social and Political Unrest

Social and political unrest has become an ever-present risk for businesses and governments alike.

Gregory says: “We’ve witnessed waves of social and political unrest over the last couple of years, and I would be shocked if we don’t see more. This stems from the populism sweeping across the globe and the division in thought on whether governments or corporations are fulfilling their obligations responsibly. Activism, too, is on the rise.”

This can lead to both business disruption and reputational damage. Understanding how your company’s association with certain socio-political stances could be perceived is critical. And this landscape evolves with lightning speed, which means that businesses need to adapt quickly.

Risk managers play a vital role in guiding organisations through this increasingly turbulent environment. By understanding the nuances beneath risks and aligning strategies accordingly, businesses can not only survive but thrive in today’s complex world.

No comments yet