A mushrooming global population is heralding a new era for risk. How individuals and businesses react to longevity risk now is of crucial importance

Global demographics are shifting in a manner never seen before. According to UN estimates, the number of people aged 65 or older will exceed the number of young people by 2050.

To take an extreme example, adult nappies are forecast to outsell baby nappies in Japan by 2020.

From such a significant swing, key risks emanate. Longevity risks concern the population’s life expectancy exceeding expectations, resulting in greater-than-anticipated cashflow needs in retirement.

This impacts individuals and businesses in different ways. For individuals, longevity risk involves outliving your assets and suffering a considerable reduction in your standard of living.

When it comes to businesses and other institutions, they are exposed to greater liabilities providing covered individuals with guaranteed retirement income.

“An ageing workforce is truly a double-edged sword,” says David Ralph, head of risk management & compliance at PCCW Limited.

“On the one hand, the ability to retain and continue to exploit the significant knowledge base and experience built up over the many years of a person’s career is an invaluable asset for any business.

“However, we are also faced with the need to use and maintain significant amounts of ‘legacy’ technology, and to do this we must have the first-hand experience of those who have been most familiar with it throughout its life-cycle, as often the younger generation have no knowledge and less inclination to learn about such ageing technology.”

Michael Sherris, professor of actuarial studies at UNSW Business School, says longevity risk has obvious implications for labour supply.

“An ageing workforce will require more flexible approaches to retirement and ways of taking advantage of more flexible working hours that older aged workforce will most likely want,” Sherris says.

“Health and financial services for older people will be new business opportunities and this will impact demand for younger employees.

“There is also the issue of increased cost from defined benefit pensions. Many businesses have shifted to defined contribution schemes already, but that leaves the problem of ensuring the right financial and insurance products are available when these individuals retire,” he says.

DRASTIC CHANGES

Jeffrey Yeo, assistant director at Nanyang Technological University, says the most immediate impact on any business will come when its ageing workforce starts to hinder its impetus for growth and productivity significantly.

“From a profit-and-loss angle, depending on the services and goods that the businesses are providing, the spending and consumption pattern would see a drastic shift from its current trend due to changes in the global demographics.

“While coming from the perspective of the company or business entity, the risk of succession planning, knowledge and expertise losses are something that can be of detrimental impact to its continuity and day-to-day operations.”

But PCCW’s Ralph says an ageing workforce provides significant stability and continuity as opposed to the highly mobile and volatile nature of the younger generations.

“Most people in the workforce today approaching emerging technologies and changing lifestyles have in fact been very much a part of probably the most dynamic and revolutionary and evolutionary period in the history of mankind,” Ralph adds.

There needs to be flexibility in retirement age, says Sherris, who points out that not all 65-year-olds share the same health status or the same prospects for longevity.

“Different industries will have a workforce that will have health status and retirement needs that are not the same as the average,” he says.

“Treating everyone the same, as in having a common retirement age, may not be best and especially when healthier individuals will most likely wish to work longer, even if only part-time.”

Yeo adds: “The shifts in social demographic factors such as declining birth rates, ageing populations and longevity are the current trends globally.

“These are the challenges that are faced by corporate entities and governments worldwide.”

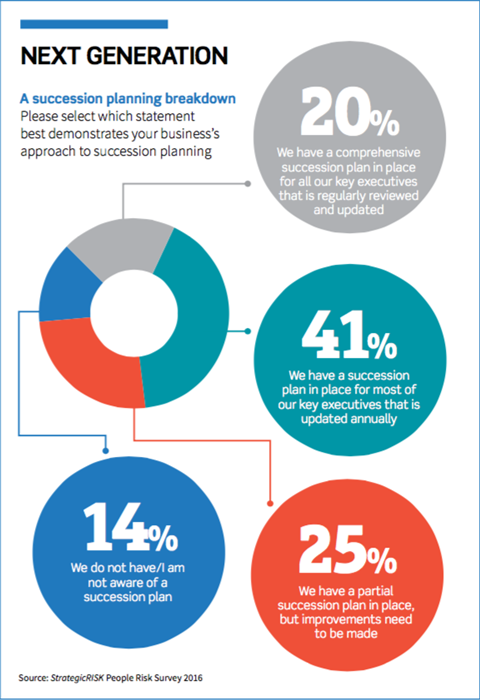

SUCCESSION PLANNING

Ralph notes that longevity risk also raises the issue of succession planning from two perspectives: “The first being that there is less emphasis being paid to this as there is an expectation that people will just continue to work and so there is less requirement to train replacements, and the other being that there is a growing dependency on knowledge and abilities of a shrinking number of individuals.”

UNSW’s Professor Sherris adds that, regardless of an ageing population, succession planning is an important consideration for companies. “Having the right leaders in a business, in a changing environment that will have longer-term effects, is critical,” he says.

“The tenure of chief executives is quite short compared to the timeframe [that] these ageing issues will impact, so it’s important to have a long- term vision and continuity in the business.

“This is better achieved with appropriate succession planning.”

No comments yet