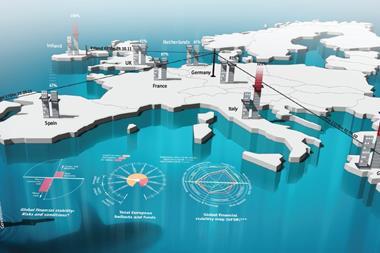

Europe’s leaders are meeting in Brussels this week to thrash out a solution to the expanding economic problems that are stifling the eurozone.

An agreement will be very hard to come by because most of Europe’s statesmen have political problems of their own back home. But it looks as though the heads of state will try to come together on beefing up the European financial stability fund—including possibly a €110bn bailout for Europe’s banks.

The European Commission set out a roadmap agenda ahead of the meeting calling for decisive action in five key areas: Greece, stabilising the euro, banks, growth-enhancing policies and economic governance.

Commission President José Manuel Barroso said, ‘Only in this way will we be able to convince our citizens, our global partners and the markets that we have the solutions that measure up to the challenges all economies are facing.’

According to the European Commission website these are the details of the roadmap:

Greece

EU leaders must remove any doubt as to Greece’s economic sustainability.

The Commission has already coordinated bilateral loans worth €110 billion provided by other EU countries and the IMF. The loans are provided in instalments – making the sixth such instalment available quickly will help dispel concerns over the Greek economy.

The final loan is foreseen for June 2013, and the Commission is now calling for EU countries to reach agreement on a second plan, involving both the public and private sectors.

Crisis control

Decisions taken in March and July increased the EU’s lending capacity to €440 billion and increased the flexibility of the European Financial Stability Facility, under which the EU can provide financial assistance to eurozone countries in trouble. The Commission is calling on these decisions to be implemented as soon as possible.

Banks

Only a coordinated approach will strengthen Europe’s banks. The EU has already changed the way banks are supervised. New rules increase the amount of capital base that banks must have, address risky re-securitisation practices, ensure salary policies do not encourage excessive risk, and increase protection for ordinary bank deposits.

The roadmap calls for the banking system to be strengthened through recapitalisation. Banks should first use private sources of capital, with national governments providing support if necessary.

Policies for growth

A number of growth-boosting policies have been agreed, but not all have been implemented. EU countries need to remove barriers to trade in the services sector , for example. Fully implementing the free trade agreement with Korea will boost growth, as will speeding up decisions on a European patent, simplified accounting for small businesses, energy savings and more.

Economic governance

The roadmap seeks to integrate initiatives such as the European Stability Mechanism and the Stability and Growth Pact into one economic governance system. This would enable the Commission or Council to intervene in the preparation of national budgets and monitor their execution.

Ordinary people have not been forgotten in the drive for growth and stability. The EU has set targets for lifting at least 20 million people out of poverty, increasing employment and increasing the number in education.

The results of the discussion on these points will feed into the next G20 meeting, scheduled for 3 and 4 November.

No comments yet