Two rating agencies lower their credit ratings by one notch as cleanup costs from the Gulf oil spill mount up

Two of the major rating agencies cut their ratings on BP’s long term debt by one notch as costs of the Gulf oil spill cleanup continue to mount up, reported the Guardian.

Fitch and Moody’s cut their ratings by one notch to the third highest investment grade rating. Fitch cut to AA from AA+, also lowering its outlook on BP debt from stable to negative—suggesting the company might suffer a further downgrade if the cleanup costs escalate further.

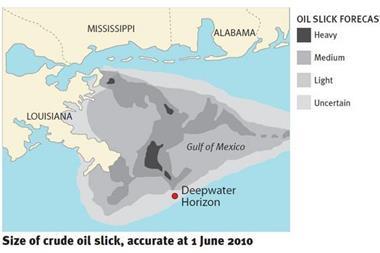

"The downgrade of BP's ratings reflects Fitch's opinion that risks to both BP's business and financial profile continue to increase following the Deepwater Horizon accident in the US Gulf of Mexico," said Fitch.

"The company has so far repeatedly failed to stop the resultant oil leak and has instead reverted to containment methods that are yet to be fully implemented and are subject to potential weather related disruption."

Moody’s also downgraded BP from AA1 to AA2 on its scale and put BP on review for a further downgrade.

Fitch estimated that the clean-up costs of the disaster could reach $5bn (£3.4bn), reported the Guardian.

Standard & Poor's cut BP's outlook to negative in early May.