Can emerging powers rebuild the world economy, asks Rebecca Jackson?

As the world emerges from the financial crisis one of the key questions being asked is how have the emerging economies fared? The eyes of the business world will turn in particular to the BRIC economies of Brazil, Russia, India and China.

For the last ten years these countries have been the engine of global economic growth, particularly in the developing world. Now as the global economy rebuilds itself, a lot depends on how those countries have been damaged, reformed, repaired or hindered by the mayhem of the last year.

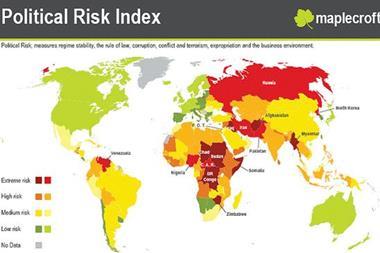

A Maplecroft risk index quantifies the integration of the BRICS (South Africa is included as a regional power) with 170 economies around the world. The index showed that although there are common threads to integration of the BRICS—often with resource-rich countries and countries with serious governance issues—their integration into the world economy is varied and patterns of interdependence are far from uniform.

The impact of the global recession on the BRICS will be felt differently across the world, particularly where countries are over-dependent on emerging powers. It is in these locations that potential risks to countries and businesses are greatest.

Integration with the BRICS can be an asset for host economies. Trade with the BRICS can boost economic development. Increased global demand for commodities, driven primarily by the BRICS, has pushed up commodity prices, benefiting exporter countries.

Between 1997 and 2002, Sub-Saharan Africa’s GDP growth rate was just 4.1%. By 2007, this had increased to 6.6%, thanks partly to strong demand by China and India for raw materials.

But the global recession is showing that, for governments and businesses, there are risks associated with developing countries over-dependence on the emerging powers. This is bad news for countries such as Angola (37th most integrated) and Equatorial Guinea (31st most integrated), who are heavily reliant on Chinese oil imports.

“Increased dependence on the emerging powers can have negative governance consequences.

The real trend, however, is one of continued overseas investment by some of the BRICS, which reflects long-term strategic thinking. As western investors get more risk-averse, Chinese and Indian companies appear to be using their extensive foreign exchange reserves to obtain cheap investments overseas. In 2008, global overseas direct investment (ODI) fell, while Chinese ODI increased by 64% and Indian ODI increased by around 2%.

The global recession has affected each of the BRICS differently. However, the developing world has and is being affected by changing patterns and levels of integration with the BRICS.

First, for countries highly integrated with the BRICS any decline in imports could have significant impacts on economic growth and poverty levels. The Democratic Republic of Congo, for example, is ranked as extreme in Maplecroft’s Poverty Index and is highly dependent on China (it is ranked as 20th most integrated), as it is a key commodity supplier.

Second, as western investment and development assistance decreases and those of the BRICS increase, the leverage of the BRICS over developing countries could increase. This is evident with one of China’s highly integrated countries, Angola (38th most integrated), whose President Dos Santos has made two trips to China in the last five months to ensure his country continues to have access to Chinese funding. This is despite policies aimed at diversifying the Angolan economy.

Third, increased dependence on the emerging powers can have negative governance consequences. For example, in Zambia, after trying to find alternative investors, the government finally announced that a Chinese firm would be running the Luanshya Copper Mines, despite disputes with the government over Chinese working practices.

Much has been made of the problems associated with development assistance from emerging powers. BRICS nations do not insist on the conditions that accompany commitments of western development assistance and their aid is often seen as political.

At the end of 2008, for example, China promised Cambodia unconditional development assistance of US$257m for 2009, more than that offered by Europe or Japan. Unconditional aid in these circumstances can be seen as a political bargaining chip for continuing access to essential resources. Cambodia is the 5th most integrated country in the BRICS index and rated an extreme risk in Maplecroft’s Business Integrity and Corruption Index. As countries increasingly come to rely on development assistance from the BRICS, there is a risk that poor governance will become entrenched.

“As countries increasingly come to rely on development assistance from the BRICS, there is a risk that poor governance will become entrenched.

In recognition of their increasing importance to the global economy, the leaders of the BRICS have gathered this week at Yekaterinburg in Russia for the first ever BRICS summit. The BRICS aim to push for a greater say in global governance to reflect what China’s Vice Foreign Minister, He Yafei, called: ‘The significant role of these countries [the BRICs] and their impact on the global arena.’

‘The growth of the BRICs is fundamentally changing the patterns of economic and political international relations,’ added Jim O’Neill, Goldman Sachs chief economist. ‘This will become increasingly evident over the next few years, as the economies of the US and Europe struggle to recover, those of the BRICs will prove to be more robust, and will be instrumental in pulling the world out of recession.’

O’Neill also believes that by 2027 the BRICS economies together could be larger in dollar terms than the G7, although much of this growth will come from China, the real engine of the BRICS machine.

But as the BRICS help the world to recover from recession, it is increasingly important that their governments and companies adopt responsible practices in order to ensure economic gains made over the last decade and poverty reduction across the developing world are maintained. For those countries highly integrated with the BRICS, efforts should be taken to mitigate the impacts of over-reliance and diversification should become a key strategy for the long-term.

Rebecca Jackson is an economics analyst at global risks specialist, Maplecroft

See also: Doing business in India