Extremists and activists from across the spectrum are evolving their narratives

Aon’s 2021 Risk Map finds that the COVID-19 pandemic both suppressed and aggravated terrorism and political violence risks in 2020-2021. The scale of government intervention, economic inequality and public unrest about government responses to the COVID-19 pandemic will continue to play an influential part in growing global unrest.

Vlad Bobko, head of Crisis Management, London Global Broking Centre, Aon said: “The COVID-19 pandemic has complicated an already fractured landscape of geopolitical risks, which firms operating globally need to navigate.

”From rising instances of civil unrest, to economic dislocation and the long-term potential for inflation in an increasingly connected and volatile world, informed decision-making has never been more important.”

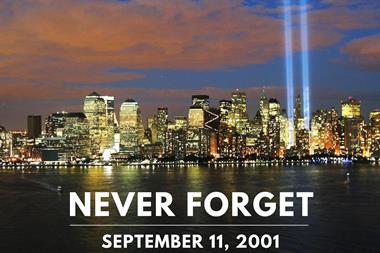

Terrorism and political violence

COVID-19 restrictions dampen terrorism and political violence, but uptick expected:

Lockdowns and travel restrictions have had a containing effect on most forms of terrorism and protest in 2020 – the percentage of countries exposed to terrorism and sabotage fell to 45% – with surges in incidents mainly accompanying an easing of restrictions. As a result, terrorist attacks fell overall worldwide.

However, extremists and activists from across the spectrum are evolving their narratives; the pandemic has been an opportunity to build support and challenge established orders and forms of governance through protests and violence. For example, the US saw a sharp rise in civil unrest and insurrection risks.

Jihadist violence rose overall by 20% in 2020:

The majority of this activity was in conflict zones, such as Iraq, Syria, Afghanistan and Mali, all of which are reliant on external military and political commitments to ensure stabilisation. The impact of COVID-19 on these fragile states was also factor.

Political risk

Political risks have risen during 2020-2021. Seven countries experienced a deterioration in the political risk situation, and none experienced an improvement. This follows a significant uptick inflation in emerging markets (EM) in 2021, a setback for green recovery initiatives following COVID-19 and the risk of EM divergence from developed markets in terms of per capita incomes, as a result of lagging and insufficient vaccination implementation in EM.

The green recovery at risk:

Rebuilding better in the wake of COVID-19, and especially rebuilding greener, has been presented as an opportunity by most international institutions, especially the European Union.

The economic case for a green recovery is based on job creation and ultimately less expensive energy costs.

Yet the fiscal burden of addressing the COVID-19 crisis has meant that by the end of 2020, fewer than half of the Paris Agreement’s signatories had delivered on its core provisions – to raise the ambition of their contributions towards achieving the goal of limiting the global average temperature increase to 1.5 degrees above pre-industrial levels.

Frontier market supply chains increasingly vulnerable:

Supply chain disruption risk, exacerbated by climate change and extreme weather, is a growing issue for frontier markets where COVID-19 has resulted in much wider fiscal balances, higher inflation and larger debt burdens.

As a result, these countries are at greater risk of falling behind in efforts towards climate change mitigation. However, rising commodity prices and inflation can help in reducing the debt burden of commodity-focused emerging markets.

Aon developed the 2021 Risk Maps, which examine political risk, terrorism and political violence globally, in partnership with Continuum Economics and Dragonfly.

Henry Wilkinson, chief intelligence officer at Dragonfly, said, “The pandemic is a long-tail risk that has created an artificial near-term global risk picture, particularly of political violence risks. The extraordinary measures to contain the pandemic have been suppressive but politically aggravating.

A tide of increasing risk by 2022 is likely as mass vaccinations and an easing of restrictions converge, with the accumulated economic and political effects of the pandemic. The need for reliable and actionable data, intelligence and analysis to manage fluid and high-impact global risk exposures while planning for recovery is critical.”

Continuum Economics Lead Economist Francesca Beausang said, “COVID-19 has shaken the foundations of the global economy over the course of 2020-2021. While global trade has recovered faster than expected from the initial COVID-19 outbreak, disruptions to the supply chain have taken new forms and their impact has become more systemic.

Meanwhile, COVID-19 has triggered an acceleration of commitments to a green recovery yet funding a fair transition to decarbonisation for emerging markets remains the greatest challenge to its implementation.

Finally, COVID-19 has forced a rethink of the concept of health as global public good, with a patent waiver for COVID-19 vaccines changing the foundations of innovation in pharmaceutical research.”

No comments yet