The D&O market is deeply troubled and some insurers will be forced into insolvency over the next 18 months

More insurers are likely to get into solvency problems as a result of falling investment incomes and a sharp rise in Directors & Officers (D&O) claims, according to industry experts.

The D&O market is deeply troubled, explained a panel of speakers at a Willis seminar in London. And in the course of the next 18 months some D&O insurers will be forced into insolvency, predicted Edward Smerdon, partner with the law firm Reynolds Porter Chamberlain.

After 5 years of consistently cheaper premiums and broadening policy coverage the soft market is finally at an end. The momentum behind the swing is the economic crisis.

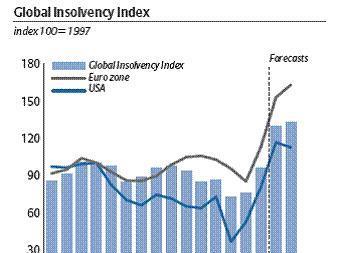

Directors should be concerned because all the ingredients for a claims ‘perfect storm’ have converged at the same time, said the panel. Traditionally the biggest driver for D&O liability is corporate insolvency. The bankruptcy rate has rocketed since September 2008 and is widely predicted to increase considerably more. Strengthening the D&O cocktail are greater stock market volatility, increased regulatory activity and more securities class actions.

Directors at financial institutions (FI) are the most likely to be slapped with lawsuits stemming from their handling of the financial crisis. Insurers focused on writing D&O in this sector, such as AIG, are the most exposed, noted Smerdon, they have already started to restrict cover and increase premiums significantly. ‘The bells and whistles of D&O policies are being stripped aside in the financial industry,’ commented Andrew Farr of Lloyd’s underwriter Sagicor.

“Strengthening the D&O cocktail are greater stock market volatility, increased regulatory activity and more securities class actions.

The UK has seen its share of financial disasters. Last year Northern Rock was the first bank to collapse after investing too heavily in subprime mortgages, HBOS was also taken over by the Lloyds Banking Group in a government backed rescue after shareholders lost confidence in its ability to survive the credit crisis. It is from these crises where the claims will arise, added Smerdon, warning further that the machinery exists in the UK for class action lawsuits.

Shareholders in distressed financial group Fortis have launched a class action lawsuit in the Netherlands claiming they were misled about its financial position.

These conditions are shrinking the global D&O insurance market—which currently stands at around $1.5bn—at a time when directors are likely to be more worried about lawsuits than ever before, said Julian Martin, executive director, Willis FINEX.

The panel encouraged buyers to examine their D&O policies to ensure they are adequately covered. At minimum buyers should make sure their policies include advancement of investigation costs and an innocent non-disclosure clause, which prevents insurers from revoking cover if honest mistakes are made in the policy submission.

No comments yet