We need investment in safety nets, infrastructure, and small and medium size companies to avoid social unrest, says World Bank president

Developing countries face a financing shortfall of between $270bn and $700bn this year, as private sector creditors shun emerging markets, according to the World Bank.

Only a quarter of the most vulnerable countries have the resources to prevent a rise in poverty, added the Bank.

In a paper ahead of a meeting of the Group of 20 finance ministers and central bank governors, the World Bank said that international financial institutions cannot by themselves currently cover the shortfall.

World Bank group president Robert Zoellick, said: ‘Preventing an economic catastrophe in developing countries is important for global efforts to overcome this crisis. We need investments in safety nets, infrastructure, and small and medium size companies to create jobs and to avoid social and political unrest.’

The global economy is likely to shrink this year for the first time since World War Two, with growth at least 5 percentage points below potential.

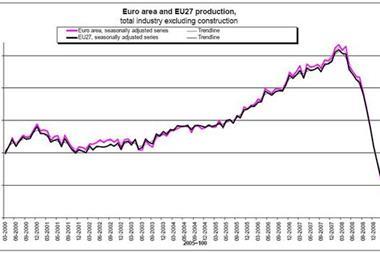

World Bank forecasts show that global industrial production by the middle of 2009 could be as much as 15 % lower than levels in 2008. World trade is on track in 2009 to record its largest decline in 80 years, with the sharpest losses in East Asia.

‘The financial crisis will have long-term implications for developing countries. Debt issuance by high-income countries is set to increase dramatically, crowding out many developing country borrowers, both private and public. Many institutions that have provided financial intermediation for developing country clients have virtually disappeared. Developing countries that can still access financial markets face higher borrowing costs, and lower capital flows, leading to weaker investment and slower growth in the future,’ the bank said in a statement.

The paper said that 94 out of 116 developing countries have experienced a slowdown in economic growth. Of these countries, 43 have high levels of poverty. To date, the most affected sectors are those that were the most dynamic, typically urban-based exporters, construction, mining, and manufacturing.

Cambodia, for example, has lost 30,000 jobs in the garment industry, its only significant export industry. More than half a million jobs have been lost in the last three months of 2008 in India, including in gems and jewelry, autos and textiles.

Many of the world’s poorest countries are becoming ever more dependent on development assistance as their exports and fiscal revenues decline because of the crisis. Donors are already behind by around $39 billion on their commitments to increase aid made at the Gleneagles Summit in 2005. The concern now is that aid flows will become more volatile as some countries cut their aid.

In remarks prepared for delivery at the same conference in London on Monday, World Bank Chief Economist and Senior Vice President Justin Yifu Lin said developed countries should spend some of their fiscal stimulus in developing countries as the economic effect could be significant.

According to Lin: ‘Channelling infrastructure investment to the developing world where it can release bottlenecks to growth and quickly restore demand can have an even bigger bang for the buck and should be a key element to recovery.’

No comments yet