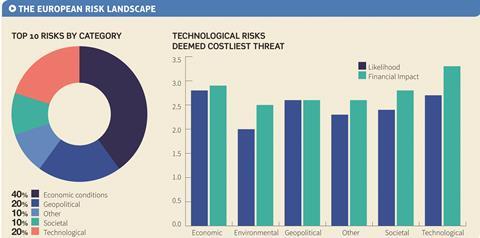

In the second of a series on Europe’s greatest risks, risk professionals gave economic threats a likelihood score of 2.8 out of five – but technological risk, while less likely to occur, have a greater financial impact

Economic risks rank among the biggest concerns for European risk managers over the next 12 months, according to a 2016 survey conducted by StrategicRISK.

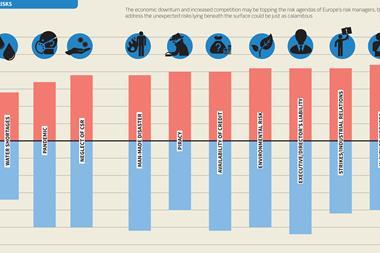

The survey of almost 50 leading risk managers found that four of the top 10 most likely risks were related to economic factors: increased competition, economic conditions, currency and foreign exchange risk, and mergers and acquisitions.

Other categories in the top 10 risk list for Europe include technological risks (targeted cyber attacks and failure to innovate), geopolitical risks (tightening and changing regulation and terrorist attacks), societal risks (attracting and retaining a talented workforce) and contractual risk.

“The core risks like damage to assets and supply chain disruption remain, but the economic landscape often changes their location,”

Overall, economic risks had a likelihood risk score of 2.8, compared to 2.7 for technological risks and 2.6 for geopolitical.

Tetra Laval International’s director of group risk management and insurance, David Howells, says the globalisation of the marketplace means that businesses now face an increased exposure to economic risks as they enter into new and emerging markets.

“The core risks like damage to assets and supply chain disruption remain, but the economic landscape often changes their location,” he says. “As organisations seek growth, their sales become focused on their emerging markets and their manufacturing base moves to contain or reduce costs.

“Doing business in new markets brings new exposures, be it credit risk, country risk, security risk or economic risk. The perception is that we are facing more and more new risks but often it is the same risks, wearing a different hat.”

Technological challenges

While economic threats topped the list of most likely risks to affect businesses over 2016, respondents said technological developments were likely to have the biggest financial impact, should they occur.

“We do not have mechanisms in place to deal with many of those [technological] risks,”

The results of the survey gave technological risks a financial impact risk score of 3.3 out of a possible five, with economic risks (2.9) and societal risks (2.8) rounding off the top three.

Speaking to StrategicRISK, the World Economic Forum’s (WEF) director of the Centre for Global Competitiveness and Performance, Margareta Drzeniek-Hanouz, says companies are often ill-equipped to cope with technological risks, despite improvements being made in the private sector.

“We do not have mechanisms in place to deal with many of those [technological] risks,” she says,” but the private sector is advancing very quickly in terms of adjusting to those risks.

“[The problem is that technological] risks also spill over into security and societal questions. Technology empowers people at the same time as governance structures look to disempower them – so new tensions are being facilitated by technology.

“As a result we will see, through those interconnections and the application of technology in different areas of risk, an amplification of risks [across the spectrum].”

To combat this, Howells says it is vital for risk professionals to carry out thorough risk analyses and ensure business practices are kept up to date in the face of constantly evolving technological threats.

“Changing and developing threats are the reason we regularly review our risk assessments and mitigation plans,” he says.

“We assess technological and cyber risks by considering information confidentiality, privacy, information integrity and availability.

“So while the threats are constantly changing, so are the strategies used to address them. By reviewing the threats against each of these categories, we can better ensure we remain focused, ahead of the threat, and that our mitigation strategies are effective.”

The latest research from the WEF, however, shows that classification of risks by categories can have its limitations.

Drzeniek-Hanouz, who is also lead author of the WEF Global Risks Report 2016, says risk managers are now seeing a range of different risks rise to the top of their agenda, rather than have a concentration of particular types of risk as their main concern.

“Until 2008, we saw a clear dominance of economic risk, then we had the emergence of environmental risk between 2008 and 2014, and then over the last two years we’ve seen other risks move up [the risk agenda],” she says.

“This year was the first year we had four out of the five risk categories represented in the top-five risks. Previously it’s been more dominated by one category, so it is visible that risks are increasingly coming together – we cannot think of it in terms of categories any more.

“The risks for today are becoming more about how they are connected and how they play into each other.”

What is more, this interconnection of risks requires risk managers to react differently to the risks their organisations are facing, as more risks are introduced that businesses may not have otherwise been exposed to.

“The risks for today are becoming more about how they are connected and how they play into each other.”

“These interconnections can give rise to cascading risk factors,” Drzeniek-Hanouz says.

“Risk managers should think about those cascading effects more seriously, rather than thinking of risks as individual events, because it’s not about individual events any more.

“It’s really about the trends that drive long-term risks and the cascading effects between interconnected risks.”

Downloads

Risk by category

Image, Size 2.69 mbLikelihood v impact

Image, Size 1.38 mb

No comments yet