Peter Den Dekker is focused on delivering an agreement with brokers over contingent commissions and influencing the impact of Solvency II on the market

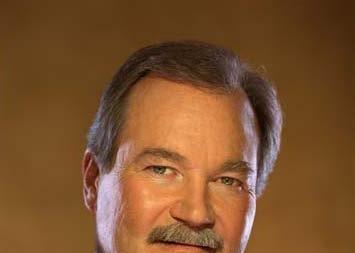

Peter den Dekker, the new president of Ferma, has taken leadership of the federation at a time of great importance for European risk managers. Ahead of the Ferma Forum he tells StrategicRISK his fears about the way companies view risk management and explains what issues he’ll be trying to get to grips with this year.

Developments in the US suggest a ban on contingent commissions agreed in 2005 may be over. One of Den Dekker’s first initiatives as president will be to establish an agreement with BIPAR, the European Federation of Insurance Intermediaries, on total disclosure of these types of payment.

‘Ferma does not want to ban contingent commissions per se but we would like full transparency of all forms of remuneration to customers,’ he says. Den Dekker thinks with this kind of active disclosure the risk manager will be able to assess whether or not the broker is acting in their best interests and decide whether to place business with them.

‘I hope that before the next Forum we will have an agreement that comes from within the industry rather than through a legislator stepping in and trying to impose regulations,’ he says.

“We monitor closely and react to any European issues that have an impact on or influence our industry.

Peter den Dekker

Looking at the impact of the financial crisis, Den Dekker says, to be successful in the future risk managers should position themselves as business facilitators rather than frustrators. ‘As long as they can do that and prove that they add value they will be involved more and more in important decisions,’ he says.

Financial firms more than any other sector will have to change the way they do risk management, adds Den Dekker. Furthermore, in the real economy and especially within publicly listed companies risk managers will need to be more transparent with shareholders about how they treat, control and manage their greatest risks.

He thinks the role of Chief Risk Officer (CRO), which many banks were historically told to adopt, does not facilitate the best form of governance. ‘I think the position of the risk manager should be an advisory role to the board and not part of the board.’

During the course of his two year term, the new president will be focused on demonstrating what Ferma can deliver for its members. One of the Federation’s biggest achievements is its work lobbying the EU on issues that affect risk managers, he says. He intends to boost this lobbying role. Den Dekker would also like to increase the number of risk managers that participate in Ferma events. He hopes to attract 500 risk managers to the next Forum.

“Ferma does not want to ban contingent commissions per se but we would like full transparency of all forms of remuneration to customers.

Peter den Dekker

Den Dekker thinks one of the biggest challenges facing European risk managers over the next two years is Solvency II, the new European risk based capital regime for insurance companies. Risk managers are concerned Solvency II will decrease competition in the European insurance market and adversely affect captive insurance companies. Ferma has set up a new working group and is cooperating with other European captive management associations to try to influence the impact of Solvency II for the betterment of its members.

‘We monitor closely and react to any European issues that have an impact on or influence our industry,’ says Den Dekker.

He concludes: ‘Being president of Ferma is an honour but it’s also a very challenging task. I took on the role because I didn’t want simply to be on the sidelines looking on. I want the opportunity to influence the whole process and to move Ferma forward.’

The full interview will appear in StrategicRISK’s Ferma Forum dailies.

No comments yet