Corporate default risk also rises fourfold, according to Mercer

The pension deficit of the FTSE350 hit £33bn, according to a quarterly snapshot of the UK’s pensions market.

The figure compares to the £13bn deficit reported in December 2007.

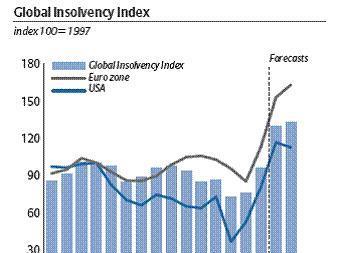

The research also showed that the insolvency risk for the 10% of FTSE350 companies most in danger of defaulting has increased four-fold in the last quarter.

In the UK in recent weeks Wedgwood, Zavvi, Woolworths and Whittards of Chelsea have all gone into administration.

Deborah Cooper, principal at Mercer, authors of the research, commented: ‘If economic uncertainty continues, and funding levels remain weak, trustees will have to balance putting pressure on sponsoring employers for additional security for scheme members while, at the same time, considering the effects on the company’s financial strength and future prospects.’