Intellectual property, currency fluctuations, political instability and lower safety and quality standards are the top four barriers to success in emerging markets

Globalisation is the chosen strategy for most large companies but it has a significant impact on corporate risk profiles - it has the affect of both increasing and decreasing risks.

In recent years, the advantages of globalisation have come well and truly to the fore. Diversifying into developing countries with strong market demand has helped large international conglomerates to weather the European and US recession. As one risk manager commented in this year’s StrategicRISK Report, the ability to do “natural hedging” in terms of services and products provided and the countries they are provided to gives more resilience against economic factors. Similarly, access to cheaper labour forces than those available in the West has helped to protect profitability.

But diversifying into emerging markets without a clear understanding of the threat landscape is foolhardy to say the least. Each region has its own specific risk issues and risk managers need to meet the challenge of assisting their boards to assess these issues in order to make the right choice for the business.

“The core drivers of globalisation are alive and well, but executives are still grappling with how to seize the opportunities of an interlinked world economy”

McKinsey Global Survey

On risks faced by their companies in emerging markets, executives cited breach of intellectual property (40%), volatility of currency or exchange rates (38%), geo-political instability (26%), and lower safety and quality standards (26%) as the top four.

Executives at North American, technology and telecoms companies were most concerned about IP, while companies in the financial sector worried most about currency volatility and energy companies about geopolitical instability.

Globalisation brings with it uncertainty

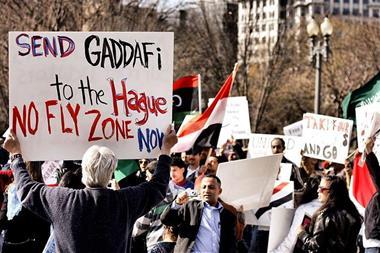

The StrategicRISK Report published earlier this year also revealed European corporations’ concerns about political developments in North Africa and the Middle East. Unrest on this scale in the countries affected had not been predicted and the speed of developments took the business world by surprise.

“Some companies with operations, outlets or suppliers in the countries concerned have been directly affected, facing serious challenges with respect to expatriates’ safety and repatriation, tangible investments protection and continuity of supply. Others believe that they may experience an indirect impact. And all are concerned that new turmoil in the Middle East could affect oil production, pushing up energy prices,” said the report.

Having property, projects, outlets and service contracts in countries with a potentially volatile political regime has to be a significant risk for global companies. Risk managers need to have adequate processes in place for enforcing property security and protecting - or even repatriating - personnel should civil unrest prove a threat. There is also a supply chain disruption risk for companies that source from such countries. And contracts with state-owned or quasi state organisations may be threatened by government changes and possible repudiation.

Understanding risk interdependence

Political risks and the effects of natural disasters are two of the immediate concerns of global risk managers. Following the Queensland and Victoria floods in Australia, the Sydney Morning Herald warned that urbanisation, climate change and globalisation are leading to more and greater catastrophes.

It quoted Erwann Michel-Kerjan, managing director of the Wharton Business School’s Risk Centre in the USA and chairman of the Organisation for Economic Co-operation and Development (OECD) secretary-general’s advisory board on financial management of catastrophes.

He said that in the 21st century there has not been a six-month period without a major crisis that affected several countries or industry sectors. The world has become an interdependent village.

The article commented that classic risk strategies are out of step with the new interconnectedness of the global economy.

“The conventional risk management approach lists possible events and determines the probability of their occurring based on experience. The problem is that it assumes risks are local and routine and fails to take into account the impact they may have on different organisations and states. It does not factor in the impact of the growing number of unlikely but potentially devastating events. It is an outdated approach that robs organisations of their agility.”

All of these comments suggest that tomorrow’s global risk manager may be a somewhat different animal from today’s. There are new risks to consider, such as lack of appropriately skilled employees, and a far more uncertain geo-political climate.

Expecting the unexpected could be the norm.