The real challenge for businesses is extrapolating value of the constant growth of Big Data

The universe is constantly expanding, but not as fast as the data universe. The digital world is doubling in size every two years, according to International Data Corporation (IDC), but organisations are yet to get a firm handle on the risks, value and potential of Big Data.

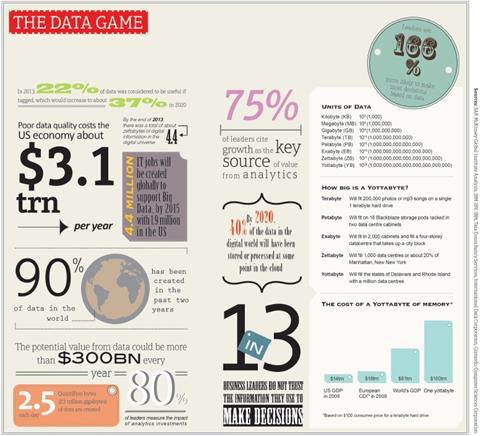

The numbers speak for themselves in respect of Big Data, although this can sometimes sound like dialogue from a science fiction movie. Nowadays, there are approximately 4.4 zettabytes (4.4 trillion gigabytes) of information in the digital universe and this number is expected to reach 44 zettabytes by 2020.

The explosion of Big Data in recent years and predictions for the future are based on the rapid development of mobile technology, such as Smartphones and tablets, that enable people to connect with each other and the digital universe, irrespective of where they are.

In 2013, by the IDC’s count, there were 187 billion “connectable things” on the planet, of which 7% were connected to the digital world. By 2020, the number is expected to rise to 212 billion, with 15% actively connected and generating new data. This only encourages organisations to exploit the enormous depths of information to gain a competitive advantage in the marketplace.

Changing rules

However, firms trading and utilising Big Data are operating in a legal minefield, as regulatory bodies close in on privacy laws with new laws and guidelines on data retention and sharing.

For example, last month, the EU Court of Justice declared the Data Retention Directive 2006/24/EC invalid on the ground that it interfered in a particularly serious manner with the fundamental rights to respect for private life and to the protection of personal data.

In addition, the EU is also in the process overhauling its data protection framework, with a draft General Data Protection Regulation currently proceeding through the European legislative process (see Governance, at pp38-41).

Understanding the laws surrounding data is the first step for businesses hoping to navigate successfully through the hoards of potentially valuable, but often useless information available.

The second step is extrapolating that potential value and turning it into revenue.

Finding tangible value in Big Data is fundamental, according to Errol Gardner, intelligence and analytics leader and partner, financial services at EY Europe, Middle East, India and Africa.

“You could argue that, in the world of causality, the growth of world data doesn’t actually lead to any value in terms of growth in the world economy,” says Gardner. “You could spend a lot of time looking at information, getting new data and not driving any value. What is key and critical is that industry must look for the value and the significant opportunities out there.”

The IDC reports that a little more than 1% of data in the digital world is considered target rich, meaning that the data is easy to access, available in real time, has a wide footprint and/or holds potential to change a company.

The potential value of Big Data to the insurance industry is huge, according to experts, but unlocking it may require cross-industry co-operation, says Stephen Lathrope, managing director insurers division at global insurance and financial services IT solutions provider, SSP.

“Big Data isn’t just about insurance companies, it’s about intermediaries, brokers, agents, loss adjusters and customers. The opportunities and insight they present won’t respect the boundaries of organisations,” says Lathrope.

“We’re going to have to work across those boundaries. There are some great examples of where the insurance industry has done that, but it’s also an area where our customers might have expected us to get there a bit quicker.

“There are some real practical challenges, a universe of potential and a real need to dive down and say what are we actually going to do with Big Data?”

Asa Gibson

No comments yet