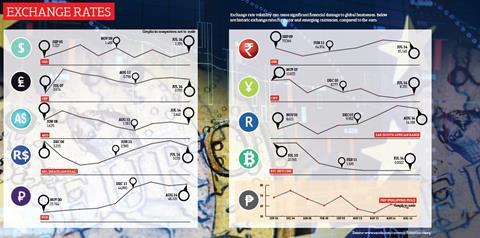

High levels of volatility in today’s foreign exchange markets is spreading concern among C-suite executives

The expansion of corporate activity into emerging economies, accelerated by globalisation, has left multinationals increasingly exposed to foreign currency risks.

An organisation’s balance sheet is continually threatened by foreign currency exchange rate (Forex) fluctuations and, as businesses continue to capitalise on the growth in emerging and developing economies, their exposures increase.

Exchange rates are affected by a multitude of factors, including changes in the geopolitical landscape, which can often manifest themselves in violent separatist movements, such as the ongoing conflicts in the Middle East and Eastern Europe.

For example, the rouble reached a record-low against the dollar on 1 September, according to Reuters, as the crisis in Ukraine began seriously to affect businesses trading in or with Russia.

Keeping abreast of global events is, therefore, fundamental when assessing a firm’s Forex exposures. Nevertheless, the biggest shock to Forex markets in living memory had not been predicted and the consequences were devastating.

The financial crisis in 2008 sent shock waves around the world and the Forex market went into a state of relative chaos.

“Following the financial crisis, it’s easier to list those currencies that were more stable than those likely to move quickly and by large amounts,” says Carl Hasty, director of international payments at UK-based Forex specialist Smart Currency Business.

Six years after the crash, Forex markets remain uncertain. For risk managers, mitigating the risk has become a fundamental part of their role and, for some, it is a matter of implementing and embedding simple principles.

“We always make sure we are paid in the same currency we pay our employees in, and that really minimises the risk,” says chief risk officer at logistics firm Katoen Natie Carl Leeman.

“We also have an engineering department whereby we buy equipment that could be delivered or supplied in different countries,” he adds. “In that case, we have a multi-currency deal that means we try to negotiate that the client pays us in the same currency that we have to pay for the equipment.”

For Leeman, managing the firm’s exposures is a case of ensuring payments are received and made in the same currency, avoiding any exchange altogether. However, this is by no means an easy solution considering the firm’s far-reaching locations of suppliers, manufacturers and clients.

“We have delivered equipment in Saudi Arabia that was partly produced in Germany and was paid partly in US dollars, so it’s a case-by-case issue but the principle is always the same: we are paid in the same currency that we must pay our suppliers.”

Volatility worries

Nevertheless, for many multinationals, using Forex markets is not so easily avoided and anticipating where the next major surprise will come from is an ever-present worry for many corporates. “The average company is exposed to about 80-100 currency pairs,” says Wolfgang Koester, chief executive at US-based Forex analytics provider FiREapps.

“Because the direction of the euro v dollar can be different than the euro v British pound, sophisticated companies are no longer focused on the direction of one currency, such as the euro, but on their entire portfolio of currency exposures.”

The volatility that exists within today’s global Forex markets is a serious concern at the executive level of most multinationals, according to Koester.

“Many chief executives and chief financial officers are worried about volatility picking up significantly for the remainder of 2014 and beyond, and the effect it could have on their financial statements.

“That volatility can flush out the known unknowns, such as exposures and resulting processes that they may not be aware of or focus on,” Koester says.

Considering the sensitive nature of the current global economic environment, Forex fluctuations − even outside of the major currencies – can cause significant damage to a firm’s financial stability. Accounting for the volatility in current Forex markets, therefore, requires special attention, explains Hasty.

“The level of uncertainty that currently exists in exchange rates makes planning for businesses that trade internationally – whether selling, buying or both – key, given the currency risk,” he says.

“Movement in exchange rates can have a material effect on profitability and cash flow if not properly understood or managed. Even within the major currencies, over the course of 12 months there can be movement of more than 5%.”

No improvement on the horizon

The level of risk posed by Forex markets is unlikely to subdue argues Hasty, who cites deep-rooted issues in the economic infrastructure of Western countries as a cause for long-term concern.

“The major problems for the Western world economies and their respective currencies are twofold: debt levels, government, banking and personnel, and high levels of regulation that affect competitiveness,” he says.

“Both of these still need to be addressed fully. Some countries are more advanced than others in dealing with them, but few countries – if any – can say they are completely on top of these problems. As such, any currency can be subject to unexpected shocks and, therefore, rapid changes in value.”

The financial crisis had significant consequences on the direction of global economic growth, with Western corporates investing heavily in emerging economies to capitalise on growth. As a result, Forex exposures are more numerous for multinationals and the current volatility of exchange rates compounds those exposures. Asa Gibson

No comments yet