Academic studies are now reinforcing the perception of the growing possibility of economic disaster if a large hurricane hits one or more of the big US metropolitan area

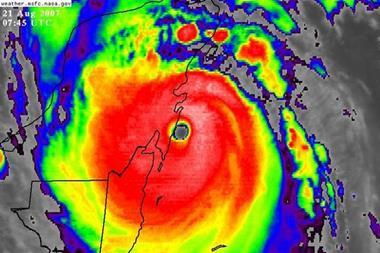

Academic studies sparked by the wide spread effects of Hurricanes Katrina, Rita and Wilma in 2005 are now reinforcing the perception of the growing possibility of economic disaster if a large hurricane hits one or more of the big US metropolitan areas.

“Potential damage from storms is growing at a rate that may place severe burdens on society,” is the conclusion of a group of scientists well known to the insurance industry, including Roger Pielke from the University of Colorado and Mark Saunders, head of weather and climate extremes at the Benfield UCL Hazard Research Centre in London.

The results of their research appear in their paper, “Normalised Hurricane Damage in the United States: 1900-2005”, in the February 2008 edition of Natural Hazards Review. In it, the authors estimate that a repeat of the worst hurricane so far to strike the United States, the 1926 Great Miami hurricane, could result in $500 billion in damages in less than 15 years at the current rate of growth of people and assets.

They warn unless action is taken to address the growing concentration of people and properties in coastal areas where hurricanes strike, the cost of damage will increase further, because there are more people living in these vulnerable locations and they are wealthier, without even taking into account the possibility that climate change is leading to more intense storms. Managing Large Scale Risks in a New Era of Catastrophes, a report from the Wharton Risk Management and Decision Processes Center in conjunction with Georgia State University and the Insurance Information Institute, makes the same argument about increases in people and value at risk. It points out that the population of Florida was 2.8 million in 1950, 13 million in 1990 and is projected to grow to 19.3 million in 2010. The insured exposure in Florida coastal areas was $1.9 trillion in 2004 and growing.

The study focussed on four states, Florida, New York, South Carolina and Texas, that have the greatest property values at risk from hurricanes and significant differences in insurance market regulation and public-private risk sharing systems, and on the main metropolitan areas in these states. Perhaps not surprisingly, the Wharton study argues for a more rational approach to the problems of insurability for many of the US residents who now live in hazard prone areas. It sets out as a first principle that insurance premiums should reflect risk to provide signals to individuals as to the hazards they face and encourage them to effect mitigation measures to reduce their vulnerability.

The second principle is that any special treatment for residents of hazardous areas should come from the public purse and not crosspremium insurance subsidies. The report concludes with proposed strategies to encourage individuals to buy adequate insurance and adopt mitigation measures.

No comments yet