Bank lending is at an all time high, says new research

The obvious answer is no, but according to a leading consultant many of the assumptions about the credit crisis are wrong.

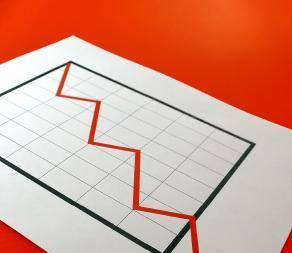

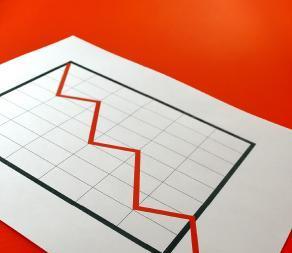

Like the belief that bank lending is frozen. Overall lending by US banks is at a record high and has actually increased during the credit crisis, claimed Celent, part of the Oliver Wyman Group, in a report recently.

Celent made similar claims about interbank lending and consumer credit, both, according to the consultant, are at record levels and have increased during the credit crisis. Another finding suggested that lending by banks to businesses is also at record highs.

It is not as though someone has pulled the wool over our eyes. The world is clearly in the depths of a serious financial crisis. Several major institutions have failed and entire countries have been forced to empty their coffers and make dramatic interventions in the markets.

What Celent’s research has done is raise doubts about the nature of the credit crisis, which may have implications for the policies undertaken to shore up the system.

“Short-term credit in particular has become significantly cheaper, not more costly

Citing a study by the Federal Reserve Bank of Minneapolis Celent accused US policymakers of ‘substituting hard data with their own speculation’.

At the end of November 2008 US Treasury Secretary Henry ‘Hank’ Paulson said: ‘By mid-September, after 13 months of market stress, the financial system essentially seized up and we had a system-wide crisis. Credit markets froze and banks substantially reduced interbank lending.’

But the consultants said the freezing of the credit markets that Secretary Paulson cited is not visible. Overall US banks reached an all time lending high of $10 trillion by October 08, said Celent. ‘The failures of Bear Stearns, Lehman Brothers, AIG, WaMu, and Indy Mac do not appear to have had any impact on the aggregate lending activities of US banks.’

'The market has absorbed these stresses beautifully,' noted Octavio Marenzi, analyst and author of the report.

In October 2008, Federal Reserve Chairman Ben Bernanke said: ‘Businesses, too, are confronting diminished access to credit.' Celent dismissed this as well claiming that the opposite is true.

“The market has absorbed these stresses beautifully

The consultant even claimed that the current growth rate in commercial lending was ‘unsustainable’. ‘A sharp contraction in commercial lending may occur in the near future,’ warned the report.

The authors also made surprising claims about the cost of credit: ‘With the dramatic drop in interest rates over the past year, short-term credit in particular has become significantly cheaper, not more costly.’

A cheery picture was also painted of the lending situation in Europe. ‘Commercial lending in the three major Eurozone economies was at its highest ever at the end of October 2008, having shown steady growth since late 2005.'

Perhaps things aren’t so bad after all.

No comments yet