Caroline Cruickshank discusses meeting collateral requirements and provides a lesson on insurance trusts which are an attractive alternative to letters of credit

In 1936, Dale Carnegie, a famous American lecturer on courses in self-improvement, corporate training and public speaking, spoke to students at Princeton University on the merit of his self-help seminars. Faced with a disheartened depression-era audience, he defended the necessity of one’s continued investment in self-development and education as an important driver to advancing society and enabling a quicker return to prosperity. To emphasise his point, he referenced Herbert Spencer, a Victorian philosopher and prominent political theorist, who had said that ‘Education is the ability to meet life’s situations. For the great aim of education is not knowledge but action.’

Though Carnegie lived in a time when the Great Depression showed the world just how low its economy could fall, his point couldn’t be more relevant than in today’s financial environment. His reminder is timely, for if we do not seek to improve ourselves through greater knowledge and skills, we cannot overcome the mistakes which led to the current crisis. If we fail to evolve, we cannot meet life’s new challenges and prosperity will remain beyond our reach.

So, if education helps us to meet such of life’s situations, then, expanding our awareness of new market practices and risk management tools that could mitigate future systemic risks is a key first step. Here begins a novel lesson in meeting collateral requirements.

The security instinct

How can we manage risks to suit our comfort threshold? After all, the concept of security is dependent on the comfort level of the one taking the risks - a paradigm which many risk management professionals juggle in their daily activities. It is this fine balance between supporting a business’ growing needs and mitigating associated exposures to a variety of risks (such as counterparty, credit and operational risks) that has spurred the practice of security guarantees in recent years. In fact, nowhere has this practice served more consistently than for the insurance and reinsurance industry.

The (re)insurers’ instinctive approach to collateral is an effective risk management technique. This is no longer just associated with regulatory oversight relating to capital adequacy and solvency margins, but also used in everyday business transactions to secure one party’s potential insurance obligations to another. Long before the current crisis gave us pause to consider such concepts as subprime mortgages and Ponzi schemes, cedants were already quite focused on managing carrier security, credit rating quality, optimising risk transfer solutions, generating a better framework for transparency and diversifying key risks to achieve a more balanced spread.

The most common type of collateral used is the bank-issued letter of credit (LOC). LOCs are credit instruments that provide an irrevocable payment of undertaking to a beneficiary. Whether the applicant backs its LOC credit facility at the issuing-bank with a deposit of assets, or whether the issuing-bank extends credit to the applicant by underwriting a loan, it remains that the legal obligation to honour a claim is shifted from the applicant to the issuing-bank.

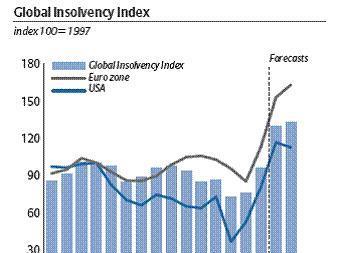

As a result of unprecedented financial losses, looming global economic recession and widespread threat of counterparty default, banks that traditionally provide LOCs (and who remain standing) are re-evaluating their business strategies and re-balancing the cost of their credit exposures. With a continued erosion of balance sheet capital causing a further tightening on liquidity, not only is the cost of credit becoming more expensive but the size and availability of future LOC capacity is under pressure.

Emerging from this void is a greater awareness of other market alternatives that not only serve the same purpose as LOCs, but may even improve the effectiveness of the industry’s practices in respect to taking collateral in the face of new market challenges. The insurance trust provides an attractively cheaper and more flexible alternative form of security.

Insurance Trust 101

Insurance trusts are accounts that meet collateral requirements for insurance obligations. They are easy to set-up, significantly less expensive than LOCs and do not encumber the depositor’s credit. Trust accounts are typically funded with financial assets that are held for a designated insurance carrier as the primary beneficiary. The collateral posted is an amount sufficient to ensure that the depositor will fulfil its obligations and can be adjusted as more or less business is undertaken. There is even potential for income that may be generated on the portfolio of assets to be directed back to the depositor, providing greater flexibility than LOCs.

There are alternative approaches to documenting an insurance trust. The essence of the concept accomplishes a separation of ownership of the assets, compromising the collateral, from the assets of the depositor. The beneficiary is therefore provided insulation from insolvency of the depositor. This, coupled with the protection the arrangement provides from a wilful counterparty default, offers comfort to both the depositor and beneficiary that the obligations of the depositor to the beneficiary are likely be fulfilled at the required time.

The concept of an insurance trust is not new. These structures have long been used by cedants in the US insurance market to address specific domestic regulatory requirements, such as New York Regulation 114, NAIC Surplus Lines and even multi-beneficiary trusts for state-wide reinsurance accreditation. What is new is the growing awareness and application of insurance trusts to satisfy a host of international scenarios involving a pledge of collateral acting as a guarantee.

The international insurance trust is typically governed by documentation recognised in the jurisdiction of the provider, experienced in the provision of trustee and custodial services, and is wholly customised to individual business needs. International insurance trusts are emerging as a new kind of additional risk management tool helping businesses to manage counterparty risk (where the counterparty has insufficient credit quality, or is outside the scope of one’s regulator). Other scenarios include collateralising obligations resulting from long-term contracts or programs with high deductibles, or simply to meet a corporate policy requiring a guarantee to secure business interests.

An example of the successful application of the international insurance trust can be seen in the European captive insurance industry helping to meet growing cross-border collateral requirements.

A lesson for captives

The captive is an increasingly important component of the risk management and risk financing strategy of the parent that forms it. A captive which insures its sponsor’s liabilities may engage with a fronting carrier who typically imposes a security requirement that demonstrates the captive will be able to pay insurance obligations. In today’s highly competitive insurance market, fronting carriers understand the need to adapt requirements according to market conditions and are recognising that alternative forms of security such as that provided through trust structures offer a viable choice. Like their US equivalent, international insurance trusts, as implemented in Europe, are helping onshore and offshore captives to meet the requirements of doing business with EU cedants, as well as in other regions where their footprint is expanding.

In Europe, captives who have already been using their cash to guarantee LOCs at an issuing bank are converting those assets for direct deposit into a trust. Aside from the cost savings, a trust can aggregate all liabilities (irrespective of line of business) into one trust per carrier thus facilitating more streamlined reporting and removing the intensive back-office administration to track multiple LOCs and yearly renewals.

Choosing the right provider can also contribute to the overall efficiency of a trust arrangement. Since potential claims could span for many years, the trustee and custodian should demonstrate a long term commitment to serving its clients, as well as the requisite experience and global resources to not only administer virtually any kind of financial asset, but also to provide a one-stop-shop of solutions across various jurisdictions worldwide. European captives should also consider the provider’s ability to offer value-added services that can customise arrangements through the provision of comprehensive investment options, analytics and accounting services that may further unlock the potential of assets while in Trust.

In conclusion, Carnegie’s reference to the philosopher Herbert Spencer in his address to the Princeton students was quite prophetic, since Spencer was originally known for coining the phrase ‘survival of the fittest’ in his Principles of Biology, after studying Charles Darwin. This is another fortuitous reminder that those who take action with more efficient risk management resources in the post-crisis order will stand a better chance of escaping the business world’s equivalent to ‘natural selection’. The use of security guarantees and alternative collateral solutions are simply additional risk management tools that, if used efficiently, can support the market’s return to stability. Understanding your options is a key first step.

After all, the aim of expanding our knowledge is to take action.

Postscript

Caroline Cruickshank is a new business development officer in the London office of the Bank of New York Mellon, E-mail: caroline.cruickshank@bnymellon.com