Disaster losses are rising dramatically throughout the world, with only 25% of economic losses insured, according to Munich Re. Insurance penetration in developing countries, and specifically in the lowest income segments of societies, is very limited. Governments and individuals in these areas generally self-insure after disasters, often diverting scarce resources from development projects for short term emergency relief. Poorer countries and individuals can be trapped in a cycle of shock and recovery from disasters, instead of achieving sustainable development progress.

Thus, financial risk transfer strategies are needed to help economies minimise losses and provide safety nets for communities affected by disasters.

Recent initiatives have shown the potential benefits of a broad range of products, from traditional insurance to newer innovations, which can be combined and adapted to different hazard settings and at various scales.

Currently, micro-insurance and parametric products using weather based indices appear to offer the greatest applicability and impact for disaster risk management in developing countries. The furthering of the global disaster reduction agenda needs continued development and growth of financial instruments of risk management, with the active involvement of the private sector in these efforts.

Partnership for progress

The ProVention Consortium, launched by the World Bank in 2000, is a global partnership of governments, international organisations, academic institutions, the private sector and civil society organisations, such as insurers and reinsurers. It is dedicated to increasing the safety of vulnerable communities and reducing the impacts of disasters in developing countries. From its outset, ProVention recognised that increasing the interest and involvement of the private sector in its efforts was essential. Commercial industry brings much expertise, experience and resources in risk management which are of potential great value to global disaster reduction efforts. Indeed, the rationale for creating a consortium of stakeholders was partly based on the recognition that there is a need to connect different sectors and disciplines, so that the efforts and benefits of risk management are shared.

Over the past five years ProVention has launched a number of activities involving the private sector. These initiatives helped advance theory and practice in the development of financial instruments of risk management while also serving as catalysts for new partnerships and linkages between the private sector and the development and humanitarian community active in disaster reduction. The latest event was a conference on the opportunities of insurance for disaster risk management in developing countries, held in October 2004 at the Swiss Re Centre for Global Dialogue in Zurich.

Forums were created to share knowledge, exchange views and experiences, promote good practice and innovations, and create opportunities for linkages and partnerships. Theory was linked to practice examining both global and local approaches to risk sharing.

A range of strategies

There is great potential for a broad range of risk transfer strategies for disaster risk management in emerging and developing countries. Catastrophe pools can provide certain benefits including mandatory coverage, lower deductibles for homeowners and possible incentives for mitigation. Such schemes, which tend to emerge in response to major natural catastrophes instead of before the event, are based on new private-public partnerships that supplement the private insurance market.

A number of developing countries are taking up parametric insurance mechanisms, such as weather and agricultural derivatives, with some positive results.

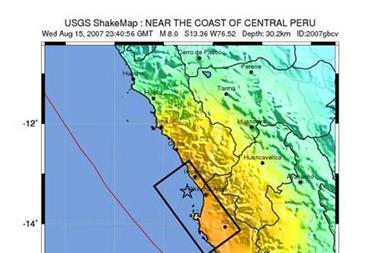

Established schemes range from agricultural flood insurance for subsistence farmers in Vietnam to financial relief from the effects of El Nino on fishery yields in Peru, with global reinsurers actively involved in many such products. Taking this a step further, the World Food Programme and World Bank are developing a similar mechanism for drought to insure adequate and timely cash flows during acute food emergencies.

Alternative risk transfer, such as catastrophe bonds, offers further interesting examples of innovative approaches to financing disaster risk.

To date, catatastrophe bonds have been issued only for large scale risks in industrialised countries, such as earthquake in Japan and hurricane in the United States, and there is some scepticism as to whether they could work in emerging or developing economies where traditional insurance systems are weak or non-existent and the market is often under-capitalised.

The insurance and compensation of losses of the very poor require specific and creative solutions which may lie beyond the scope of traditional disaster insurance schemes. Micro-insurance provides, perhaps, the most direct access and, thus, financial support to the poor and marginalised. Many established micro-finance institutions are currently implementing or experimenting with micro-insurance schemes. These schemes can insure the poor against property, casualty, life, health and credit losses, for example providing coverage up to $100. Many poor communities in developing countries have long used informal insurance schemes through various forms of solidarity pools and community social assistance. Micro-insurance can be seen as a formalisation of these risk sharing mechanisms, often managed by mutuals and cooperatives.

Work to be done

A lack of a culture of risk reduction and, thus, an understanding of the uses and benefits of insurance hampers insurance development and private sector involvement in developing countries. While experience indicates that the poor do indeed want insurance and related financial services, it must be acknowledged that premium payments must compete for limited resources with often more pressing livelihood demands. Education of potential clients is important not only for the creation of appropriate and realistic demand, but also to allow them to articulate their needs in such a way that insurance products can be developed to meet them.

At the same time, political will needs to match local insurance expertise.

The regulatory frameworks necessary for insurance provision are often lacking in developing countries, and without the political will to establish such structures, possibly enhanced by sponsors or champions of insurance within the public sector, an appropriate environment will not be created.

Private insurers are also understandably wary of developing business in possibly politically and/or economically unstable markets. Further hindering market establishment are limitations in business infrastructure, such as communications technology, which can challenge proper client and claims management.

As covariate risks, disasters pose capacity and solvency challenges for micro-insurance and micro-finance institutions, which can be addressed with insurance backing through the global market. In return, community groups such as mutuals and cooperatives can provide the insurance sector access to low income clients. Through self-management and self-regulation, these groups are able to address the challenges of moral hazard and adverse selection, while pooling clients and thus lowering administrative costs for insurance partners. They also assist in awareness-raising among potential clients with regards to using insurance products to reduce and manage disaster risk.

Business opportunity

While developing countries have much to gain from the expertise and investment of the private insurance sector, through their involvement these potential partners can develop long term business opportunities. By participating in the establishment of new markets and products in developing countries, the insurance industry is helping to create new and future demand for its own products. Driven by corporate social responsibility, (re)insurers can achieve much by participating in pro-poor partnerships, not least of which is reputational enhancement both in established and new markets.

Progress in developing new products and markets will depend upon closer collaboration and more concurrent action from international organisations, the insurance industry, the public sector and at-risk communities. At the same time, specific business cases that illustrate opportunities, challenges, benefits and costs are needed. The ProVention Consortium actively supports multi-sectoral efforts to develop insurance markets and foster cultures of pre-event risk reduction, as well as case studies and pilot projects to collect data and experiences for business case development.

Mutually beneficial partnerships are necessary for the implementation of insurance for disaster risk management in developing countries. The definition of a partnership concept must be clear to all involved, which can be challenging between organisations with different goals, operational structures and timelines. By establishing common language to foster mutual understanding, the specific roles, responsibilities and limitations of each partner's engagement can and must be clearly defined.

It is clear that diverse risk management strategies are urgently needed to reduce the rising cost of disasters. Risk transfer mechanisms can play a key role in helping to minimise disaster losses and reduce the financial and economic impacts of disasters. Greater attention needs to be given to the potential opportunities and limitations of risk transfer and, in particular, how insurance can be applied to hazard prone developing countries exposed to unacceptable levels of disaster risk and avoidable losses.

- David Peppiatt is head of the ProVention Consortium, Geneva. Daniel Kull is the programme officer.

Email: David.Peppiatt@ifrc.org

Web site: www.proventionconsortium.org