No requirement for mandatory full disclosure, but brokers oppose “overly burdensome” rules

The New York State Insurance Department released its final producer compensation disclosure regulation, but the rule does not include a requirement for mandatory disclosure of broker remuneration.

The new regulation requires brokers to give consumers detailed information about how they are being paid and by whom—but only if the buyer asks for it. Crucially, the disclosure is not mandatory and up front, as some insurance buyers would prefer. It will take effect on January 1, 2011.

The new regulation has not been received well by some brokers. A New York broker group said it was launching legal action to stop the regulation taking effect.

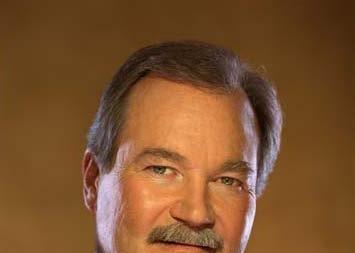

Dick Poppa, CEO of the Independent Insurance Agents & Brokers of New York, said: "Our members have unanimously and vociferously told us that this rule is unnecessary, ineffective and overly burdensome to their businesses." See more: Brokers file suit to stop transparency regulation

In most cases, brokers receive compensation for selling insurance products from the issuing insurer. This compensation is usually composed of a base commission, based on the policy premium, as well as certain year-end payments based on the volume and profitability of the policies an agent or broker places with the insurance company. These controversial payments, along with other forms of non-cash compensation, are usually called contingent commissions.

Insurance buyers who are choosing among policies may not be aware of these compensation programmes and how they affect the insurance transaction.

The proposed regulation would require that when a consumer applies for an insurance policy, the agent or broker must explain to the consumer:

• The agent or broker’s role in the transaction;

• Whether the agent or broker will receive compensation from the insurer based on the sale;

• That the compensation insurers pay to agents or brokers may vary depending on the volume of business done with that insurer or its profitability; and

• That the purchaser may obtain more information about the compensation the agent or broker expects to receive from the sale by requesting that information from the agent or broker.

Only when the consumer asks for more information from the agent or broker, must they be provided with a more detailed written disclosure of the compensation to be received.

“This regulation protects the interests of consumers while allowing agents and brokers flexibility in how they present compensation information,” said New York State Insurance Superintendent James Wrynn. “We have worked with consumers, agents, brokers and insurers to fashion a regulation that is fair to all stakeholders and takes all the comments we heard into account.”

No comments yet