International lenders are now increasingly offering supply chain finance

As multinationals grapple with the complexities of maintaining the financial integrity of supply chains in an explosion of trade with emerging markets such as Africa with its challenging and often contradictory payment regulations, an unexpected friend is emerging. They are called banks.

Help is certainly overdue. As David Noble, group chief executive of UK’s Chartered Institute of Purchasing & Supply, observed in May, on the release of the institute’s first quarterly index of supply-chain risk: “With political instability across the developing world, it is vital that businesses and economies recognise the risks to their supply chains and make the appropriate provisions before it is too late. Supply chains have a critical role to play in operational profitability and economic stability, but global supply chains have scarcely been at greater risk than today.”

The lowest-cost supply chain should not be the main factor and others should enter a company’s calculations, suggests Neil Ross, AIG’s regional manager for EMEA trade credit. “Cost often takes second place to reliability or reputation when it comes to more complex or critical goods and components. Vulnerability can result from too great a dependence on key smaller supplies.”

Too many multinational managers overestimate the value of cutting costs, argues Guenter Droese, chairman of the European Captive and Reinsurance Owners’ Association, citing an over-reliance on just-in-time warehousing and other supposed gains. The result is breakdowns in overstretched supply chains because of natural catastrophes, strikes and other events that may be predictable. “These kinds of entrepreneurial decisions are always risk decisions and they can increase or reduce profits,” he says.

Supply chain finance

The growing realisation of the dangers inherent in complex supply lines is a significant reason why AIG has experienced an increasing demand for supply chain finance. Its officers have been busy channelling financial resources to key suppliers so they have continuous access to vital working capital.

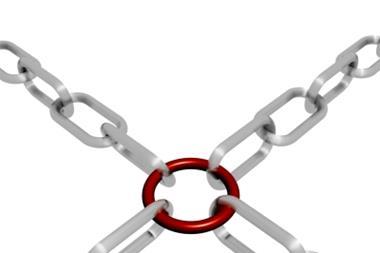

Traditional lenders have also jumped into the breach as supply chain finance is stretched to breaking point. A major anxiety for chief financial officers is the rapid increase in regulatory changes across the globe that have inevitably made transactions more complex and finely balanced. The phenomenon has been dubbed “regulation fragmentation”.

A solution could be at hand, though, namely a product known as supply chain finance (SCF) that is offered by a growing number of international lenders with specific regional expertise. As Venkatesh Somanathan, director – regional trade finance product manager at Deutsche Bank, points out, lenders have devised highly integrated SCF platforms that move the entire supply chain fully online, for buyer and seller.

“This has enhanced automation and transformed the transaction process”, he explains. “The increased transparency throughout the supply chain is particularly valuable to corporates exploring unfamiliar trading routes, where transaction requirements are diverse and effective risk mitigation is paramount,” he suggests.

Increased efficiency

In practice, SCF aims to deliver benefits along every link in the supply chain. For buyers, the system can, for instance, extend the number of days payable outstanding. For suppliers, it provides an injection of liquidity. Overall, the goal is to enhance transparency, provide better payment security, reduce costs and improve cash flow. As all corporate treasurers know, all these serve to reduce risk.

Further, lenders claim SCF makes financing more efficient. “It facilitates the rapid reconciliation of purchase orders through electronic bill of lading documents”, adds Somanathan. “Such platforms also bring greater clarity.”

Thus, banks with on-the-ground expertise should be able to guide companies through the red tape of unfamiliartrade corridors. Almost all African countries apply different systems, as do those in Asia and elsewhere. For instance, India has specific rules on payments and foreign exchange, as well as onerous reporting requirements for export financing, while China expects exporters and banks to file regulatory reports online through a portal and a customs registration form.

However, Africa, in particular, is infamous for running creaking payment methods that weaken the financing of the supply chain. Although banks are becoming involved more than they did in the wake of the financial crisis, European institutions in particular are more likely to provide finance only to the strongest, lowest-risk multinationals.

Here, insurance companies are plugging the gaps. As AIG’s Ross explains: “Insurance companies can play a bigger role as effective, risk-sharing partners for banks. We’ve seen a rising demand from= lenders for credit insurance support.” In short, insurance in the most practical and helpful of ways.

No comments yet