Power insurance market will harden further due to constrained capacity and a ‘disappointing’ loss record - WTW

Risk managers in the power sector must tackle an entirely new risk landscape brought about by the Russia-Ukraine conflict, global inflation, the energy transition, and climate change. This is according to the 2022 Power Market Review from WTW.

As power insurance prices continue to rise, risk managers must juggle these risks while ensuring that they have determined current, correct, and sufficient asset and business interruption valuations against the backdrop of rampant global inflation, a challenge which some have not yet faced over the course of their careers.

Challenges range from the technological to the geopolitical and include:

- Ways that modelling can support an industry facing challenges;

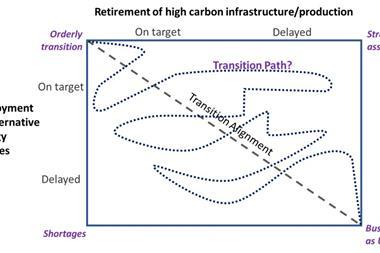

- management of physical and transition risks;

- the role of investors in the energy transition;

- directors’ potential liabilities arising from climate change;

- the impact and management of geopolitical crises; and

- the introduction of hydrogen as a fuel for gas turbines.

Power Market Review also considers the current state of the insurance market for power risks. Data and commentary covers areas including:

· Russian impact: Most power insurers have eliminated Russian exposures from their portfolios, and many have reduced or eliminated cover for coal-fired plants and other risks which they deem to emit unacceptable levels of carbon. That has introduced an increased appetite for other power risks.

· Capacity: Total global theoretical insurance capacity for power risks is approximately US$3.5 billion in 2022, with the realistically deployable level in the region of US$1.5 billion. For coal assets the total falls to just $250 million and is significantly less for new coal risks.

· Losses: The frequency of individual losses in excess of US$1 million is trending upwards and reached a three-year high in 2021. Total loss costs are set to equal or exceed total premium income for power risks in 2022, with a dozen losses in excess of US$20 million already reported.

· Rating levels: As a result of rising losses, rating increases of at least 2.5% and up to 20% can be expected in Q3, 2022 for all but a handful of risks with a clean loss record and all assets located in areas of low natural catastrophe risk.

Graham Knight, WTW’s Global head of Natural Resources, said: “One issue above all is of immediate concern to our clients: determining correct asset and business interruption values.

“Our message to the industry on this topic is quite simple: it is vital that a more transparent understanding of how insured values are calculated is communicated from buyer to broker to insurer.

”When this is achieved, buyers will see greater price stability. Better valuations will reduce the likelihood of repeating the large price swings between hard- and soft-market conditions that we’ve experienced so often in the past.

“In the meantime,” Knight continued, “power insurance markets continue to harden still further, for two fundamental reasons. First, the sector still suffers from a disappointing loss record. Second, the pool of leading insurers remains relatively limited compared to previous underwriting eras. The following market is generally more willing to accept their terms, but momentum is insufficient to reverse the market’s overall upwards rating trend.”

No comments yet