Chavez's referendum victory increase political risks but Venezuela faces a difficult year with falling oil prices

Venezuela’s President Hugo Chavez won a referendum victory on Sunday February 15 which could extend his grip on power indefinitely.

The South American country’s electoral authority announced that 54.4% of votes were cast in favour of removing term limits for Chavez and his supporters.

President Chavez has been in power since December 1998, since then he has pursued an aggressive nationalist agenda funded by oil revenues.

The lifting of presidential term limits prolongs political risk for firms investing in Venezuela but economic realities may force Chavez to make concessions.

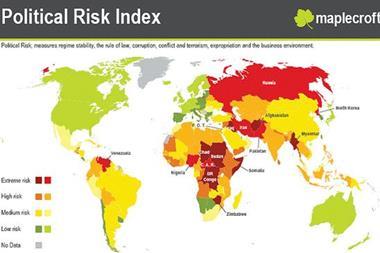

For international companies, the prospect of Chavez remaining in power past 2012 prolongs the risk of privatizations and expropriation and means the business environment remains unfavorable, noted the advisory firm Maplecroft.

But despite the victory Chavez faces a difficult year. The price of Venezuelan oil has fallen by around $90 a barrel since last July. The sharp drop in price means the President will have less money to buy assets for the state.

Political risk analysts Exclusive Analysis said the drop in oil price will curb Chavez’s nationalist agenda. He was able to acquire major sectors of the Venezuelan economy, including energy, power generation, telecommunications, steel and cement production (he is in the process of taking over mining), thanks to high oil revenues. But that is no longer the case.

‘Victory by the Chavez camp is unlikely to have major commercial implications for foreign investors,’ said Exclusive Analysis in an incident analysis.

Social discontent is also on the rise. As his mandate ends in 2012, Chavez needed to change the constitution via a referendum to remove the limit of only one presidential re-election. But opinion polls suggest that lots of people do not want to see his reelection in 2012. ‘If oil prices fail to recover in the next two years, the ousting of Chavez by popular vote in 2012 appears increasingly likely,’ said Exclusive Analysis.

No comments yet