81% of large firms are considering moving major functions abroad, finds study

The UK’s largest multinational companies are preparing to move more business functions overseas, placing a third of their UK jobs at risk, new research revealed.

Business leaders at UK-based global firms believe the potential exists for nearly a third (29%) of their current UK jobs to be transferred to lower-cost economies by 2015, blaming the dual-impact of the economic crisis and decreasing UK competitiveness for the exodus.

David Stern, UK managing partner at Roland Berger Strategy Consultants, who conducted the survey of 200 large UK companies, commented: ‘The recession has prompted our largest companies to re-examine the UK as a business location in terms of skills, cost and infrastructure. Globalisation is enabling them to consider unprecedented levels of offshoring across all aspects of their business, which could result in permanent damage to the UK job market and economy.'

UK firms pack up and go

The vast majority (81%) of the UK’s largest multinational firms are planning or considering moving at least one major business function overseas by 2015.

The study reveals a massive acceleration of international outsourcing and offshoring, with more than half of companies having already moved or considering moving support functions such as IT (68%), finance (58%) and HR (53%) overseas.

More alarmingly, however, the study shows that functions previously considered as core and permanently linked with the UK are now being moved abroad.

Although only a minority (13%) of firms have Head Offices outside the UK, another two-fifths (38%) of the UK’s multinational companies are currently considering the move in a bid to stay competitive.

Additionally, more than half of firms interviewed have moved, or are considering moving, key business functions such as customer service (64%), R&D (61%) and sales management (59%) abroad.

The study also highlights the vulnerability of British manufacturing, as nearly three quarters (72%) of these large firms have moved, or are considering moving, a proportion of this function overseas. Indeed one in seven companies (15%) has already relocated manufacturing abroad, and business leaders recognise the potential for more than a quarter (28%) of their remaining UK output to go abroad by 2015, which could affect an equivalent proportion of their current UK employees.

David Stern, UK managing partner at Roland Berger Strategy Consultants, commented: ‘This trend towards offshoring is markedly different from the international outsourcing we have seen to date, with both knowledge economy jobs and core business functions now being exported to economies which are more competitive in the global environment.

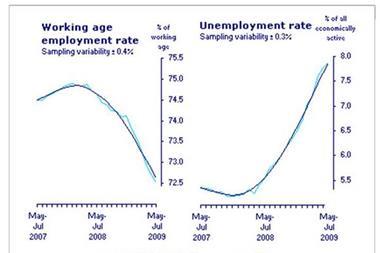

‘These are unlikely to return once the economy picks up, a trend which threatens a permanent rise in UK unemployment, leading to falling revenues and ultimately a decline in GDP.’

What’s driving jobs abroad?

Companies are being forced to offshore jobs in response to the economic crisis, and to secure longer-term competitiveness in an increasingly global economy. Firms do not feel this would hamper their operational capability, and indeed would enhance their competitiveness and ability to thrive in a globalising world.

Nearly half (49%) of respondents believe that their firm would be significantly more competitive if they moved more business functions outside the UK, and over three-quarters (76%) feel that by doing so they would be better positioned to take advantage of globalisation.

More than half (52%) of the companies interviewed state that offshoring, outsourcing and sourcing to/from low-cost economies are absolutely critical to enhancing competitiveness and hence to ensuring the future health and success of their business.

Meanwhile, more than three-quarters (78%) of UK-based global companies already considering offshoring functions cite cost structure competitiveness as a fundamental driving force behind the move, demonstrating the importance of the macroeconomic setting to these decisions.

The erosion of UK competitiveness

The Roland Berger study reveals that UK competitiveness in the global marketplace is being steadily eroded by a lack of skilled personnel, excessive operating and infrastructure costs, high taxes and a stifling regulatory burden.

The strong majority (77%) of companies highlight hefty operating costs, including high wages, as a key factor.

The next biggest contributor to the erosion of UK competitiveness, cited by more than two-thirds of firms (69%), is existing high tax rates, followed closely by the regulatory burden (66%) and low domestic market growth rates (65%), all of which combine to make overseas environments more attractive.

Additionally, over half of firms (58%) believe the UK’s competitiveness is being eroded by a current lack of skilled personnel across the value chain, which they expect to persist into the future.

David Stern, UK managing partner at Roland Berger Strategy Consultants commented: ‘The Government must help UK companies and employees become more competitive in the global market place, otherwise the trickle of jobs moving offshore will become a torrent.

‘This will require reducing bureaucracy, enhancing the skills of the labour pool and alleviating the cost burden on business, but this will present a huge challenge in the current economic climate.

‘In the meantime, companies should identify those parts of their business that need to stay close to their customers and then assess the best way of configuring their operations and support functions to achieve the greatest cost efficiency and flexibility.’

No comments yet