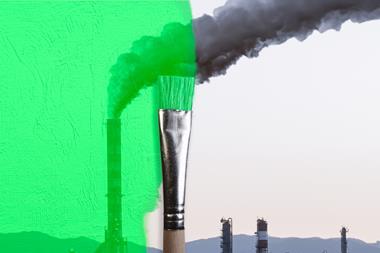

Greenwashing allegations are becoming more common, and this trend is expected to accelerate, warns Clyde & Co

Companies face growing pressure from stakeholders (including regulators, consumers and investors) to be more transparent about their sustainability efforts and the environmental impact of their products, services, activities and policies.

However, companies that make claims about their commitment to addressing climate change and ESG without sufficient evidence may be accused of greenwashing which can have civil, regulatory and (depending on the jurisdiction) potentially criminal repercussions.

This is according to Clyde & Co partners Nigel Brook and Laura Cooke. They say a range of industries including airlines, financial services and retailers, are facing increased scrutiny from consumers and shareholders regarding their Net Zero and overall climate and ESG performance.

In addition to NGO-led lawsuits, regulators are also taking action against companies that make false statements or provide misleading information about the environmental impact of their products and services.

The Green Claims Code

“Greenwashing allegations are becoming more common, and this trend is expected to accelerate given the increasing focus of regulators in multiple jurisdictions on the subject, we expect this trend to accelerate during 2023 and beyond, particularly as stricter regulations come into force,” say Brook and Cooke.

“As regulatory focus on ESG issues intensifies, companies can expect increased scrutiny of their green and sustainability statements and disclosures.”

In the UK, regulators from all industries are taking a harder stance on greenwashing. For example, in October 2022 the Financial Conduct Authority released a consultation paper proposing new rules for sustainable investment product labels, similar to the EU’s Taxonomy Regulation. These rules look set to be implemented in 2023.

In June 2021, the Competition and Markets Authority issued the “Green Claims Code” to help businesses accurately communicate their green credentials to customers.

The Advertising Standards Agency (ASA) has evaluated several green claims, including a major bank’s advertising, which was found to be misleading for omitting information about the bank’s contribution to greenhouse gas emissions. The ASA has also published guidance on making environmental and green claims in advertising.

From an investor perspective, the UK is at the forefront of requiring companies to adopt the TCFD framework (or equivalent) in their reports.

No comments yet