Corporate exposure to geopolitical risk is a key concern in 2015 as political and societal pressures increase

Even though concerns about the global economy, such as deflation in the eurozone and slow growth in key emerging markets are far from resolved, they are starting to be overshadowed, and perhaps compounded, by rising geopolitical tensions.

The financial crisis put great emphasis on economic risk in recent years as fears an asset price collapse and fiscal imbalances would further disrupt corporate operations. This was evident in the World Economic Forum’s (WEF) annual Global Risks Report, which draws on the perceptions of experts in business, academia and the public sector worldwide. Each year, respondents are asked to rate a select number of risks in terms of their likelihood and impact over the course of the next decade.

For the first time in nine years, WEF’s number one global risk in terms of impact was not an economic risk. In fact, not a single economic risk appeared among the top five risks with the biggest consequences − a list that has included two or more economic risks since 2007.

Interstate conflict with regional consequences was rated as the number one risk in this year’s report in terms of likelihood and fourth in terms of impact; high risk ratings for failure of national governance (likelihood, 3), state collapse or fall (likelihood, 4) and weapons of mass destruction (impact, 4) meant more geopolitical risks appeared among the highest ranking risks than ever before and in comparison to all other risk types.

Almost 900 experts rated 28 global risks between July and September 2014 and, given the number of concurrent conflicts during that time, it is perhaps unsurprising that interstate conflict with regional consequences was ranked so highly.

For example, during that period the Islamic State gained control of cities in Iraq and Syria and the conflict between Israel and Palestinian militants in Gaza escalated after Israel blamed Hamas for the murders of three Israeli teenagers in June. Further, political tensions in Ukraine resulted in conflict between the new government and pro-Russian separatists on the country’s Eastern border and led to the annexation of Crimea by Russia. Political and societal unrest in Hong Kong, Thailand, Egypt and Libya were also significant to the risk landscape in 2014.

In the six months since the 2015 survey was conducted, the geopolitical risk landscape has been exacerbated, according to WEF report advisory board member and Zurich chief risk officer general insurance Steve Wilson.

“The situation with Russia seems to be increasingly tense and leading military figures have made many comments warning about Putin’s agenda [in terms of rebuilding Russia’s influence in Eastern Europe]. In addition, the terrorist attacks in Paris suggest the extremist militant threat is getting worse,” he says.

The key risk for corporates arising from such political tensions concern business interruption (BI), says WEF report steering board member and Marsh president global risk and specialties John Drzik.

“The potential sources of BI are diversifying as the world evolves and fragments in a geopolitical sense, and develops in a technological sense. This [amplifies] the challenge for firms when assessing potential sources of BI and has created a more challenging risk landscape,” Drzik says.

Corporate exposure to geopolitical tensions has become a global trend that Wilson says could be a catalyst for growth in the insurance market.

“Economies are connected, trade is connected and when geopolitical tensions arise that threaten trade and contracts between businesses across borders there is a need for growth in political risk and credit risk insurance markets,” Wilson says.

In terms of risk management, firms should account for geopolitical risk when evaluating investment plans and supply chain strategies, says Drzik.

“Geopolitical events are likely to be more frequent in the next few years and could cause disruption in different parts of the world. A good risk management strategy is to avoid undue concentrations of supply chain, investment portfolio or other risk exposures the firm may have,” he says.

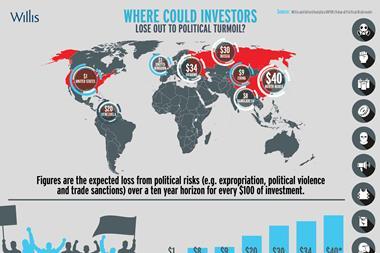

Globalisation and the financial crisis have encouraged businesses to invest in emerging markets. Now, firms are perhaps more exposed to conflict and political rivalry than ever before and at a time when the global geopolitical landscape is increasingly uncertain.

The situation in Europe is particularly uncertain: the economy is sluggish, Ukraine’s future remains unclear, tensions between the EU and Russia are rising, religious extremism is spreading from the Middle East and the election of Syriza in Greece is raising questions on the state of affairs on the continent. As with most risks, circumstances are subject to change and the geopolitical landscape is certainly one for risk managers to watch.

No comments yet