Brexit uncertainty has created a need to reassess growth plans, expected returns and risk appetite

Making informed risk-return trade-offs is of the utmost importance in the context of the macroeconomic, geopolitical and market uncertainty facing multinational corporates.

Organisations are responding very differently – ranging from a value perspective (How I can I get value from better articulating my risk appetite to cope with uncertainty?) to a compliance perspective (What is the minimum we need to do to meet the expectations of investors and the applicable governance codes?)

The recent Brexit decision in the UK has introduced a whole new level of uncertainty and with it a need to reassess growth plans, expected returns and risk appetite. However, no organisation can afford not to respond to the increased uncertainty and higher volatility that has followed.

This article sets out a clear way forward for developing meaningful and implementable risk appetite processes, and demonstrate the urgency for action in the context of Brexit.

A practical and pragmatic response to developing a robust risk appetite approach

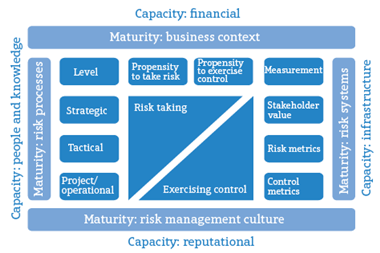

Risk appetite is often seen as a complex and esoteric topic despite the fact that it is an important feature in corporate decision-making – whether it is considered implicitly or explicitly. Businesses are collectives and, in general, do not have single decision-makers. Hence, the need for an explicit articulation of risk appetite becomes vital to ensure that the individual risk-return trade-offs are consistent, contribute to the overall goals of the organisations, and do not create unexpected or unwanted risk concentrations.

Experience shows us that the risk appetite of the board and/or executive committee as a collective can be widely different to the risk appetite expressed by individual board members. Hence, we should not assume that the risk appetite of a group is an average of the individual board members’ risk appetite. Equally, board members and the board in plenary will express very different risk appetite across the principal risks they are concerned with – and the risk appetite will be dynamic over time and situation dependent. The Brexit outcome will have changed the ‘view of the world’ of many decision-makers and board members alike – and in general, corporates are likely to reduce their risk appetite.

Some key principles

The first principle is engagement. Organisations are choosing three separate ways of engaging:

- Board taking the lead and having a principles-based discussion

- Executive committee taking the lead and seeking the board’s approval

- Bottom-up at business unit level

The board ultimately has the responsibility for the organisation’s risk appetite. However, the way that the board arrives at this will vary between organisations and also depends on the established working relationship and practices between the executive committee and the board. Irrespective of the process – the bottom-up and the top-down have to reconcile in order for the risk appetite to become an integral part of the decision-making fabric of the entire organisation.

The second principle is one of application. It would appear that insufficient focus is put on how to use the risk appetite framework at board, executive committee and business unit level. A key feature of the risk appetite framework should therefore be to define:

a) How will matters reserved for the board be impacted by the risk appetite framework?

b) How will the risk appetite framework help us make better decision in the face of uncertainty such as the implementation of Brexit?

c) The ongoing monitoring and reporting of exposures in relation to the agreed risk appetite

d) The cascade and communication of risk appetite throughout the organisation

In terms of matters reserved for the board, the most immediate priority is to ensure explicit risk-return consideration in relation to key decisions such as:

- Planning/resource allocation

- Structure of supply chain and location of assets

- Investment and divestment decisions

- Portfolio adjustments and restructuring

- Evaluation of strategic choices/options including, for example, product/market entry decisions

However, the impact on an organisation is more far-reaching than above – it also extends into:

- Decision-governance and delegated authority levels – achieving clarity and consistency across decisions and organisational entities

- Culture – creating a shared understanding of the risk-return trade-offs and how they affect individual areas of responsibility

- Tracking and monitoring – ensuring visibility at the various levels of the organisations of performance vs. risk limits, triggers and key risk indicators

Conclusions

Risk appetite as a concept has become more prominent in the corporate sector over the last 12-18 months due to changes to the governance code as well as the macroeconomic uncertainty. Following Brexit, it should now have shot to the top of the agenda in terms of the decisions that have to be made whilst the details of the exit are being negotiated.

As a consequence, new approaches and tools are being put forward to support boards and leadership teams in developing and embedding these concepts. A low tech, facilitated process which is focused on defining the principles and boundaries for risk appetite is a crucial first step – and it can be conducted relatively quickly. However, the successful articulation and embedding of the outcomes of the process is a leadership and change management challenge – and for most organisations, a change in risk-return culture is required.

It isn’t therefore enough to know that we might be taking too much risk (for an expected level of return) in certain areas and not enough in others. Organisations need the tools and processes to provide better insight on which is which, and make decisions accordingly to position the business for continued success. Brexit illustrates how a significant shift in uncertainty can change the risk preferences of the organisation, and should therefore be a good prompt to check the state of the organisation’s risk appetite and risk-return readiness.

No comments yet