New offerings will help businesses to prepare for ERM evaluations, said SAP

Software giant SAP AG has collaborated with governance, risk and compliance consultancies to provide services to help clients prepare for Standard & Poor's (S&P) new enterprise risk management (ERM) evaluations.

The agency announced in May 2008 that ERM will soon be included in its credit ratings analysis for non-financial corporations. S&P has included ERM analysis in its ratings of financial institutions and insurers since 2005.

Narina Sippy, senior vice president of SAP's governance, risk and compliance business unit., said: ‘S&P's decision to apply ERM analysis to its corporate ratings further thrusts risk management into the spotlight, and ultimately is a good thing for companies and investors alike.’

All companies seeking a positive credit rating will be required to provide evidence of a formal and effective risk management program, which S&P considers a good indicator of forward-looking stability.

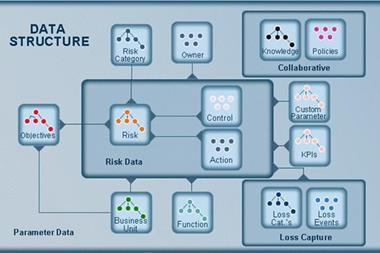

SAP said the integration of the tools, SAP GRC Risk Management and SAP(R) Strategy Management, would enable enterprises to better integrate risk and risk management into their day-to-day decision making.

The project partners include Deloitte, IBM Global Business Services, PricewaterhouseCoopers and Protiviti.

Jim Deloach, managing director at risk consultancy Protiviti, said: This approach of embedding risk monitoring into existing business processes across the enterprise not only reduces the exposure to unwanted risk events but also builds a strong risk culture within the company. More specifically, integration of risk management with enterprise performance management is where the real action is."