The sun is expected to reach the peak of its cycle in the summer of 2025, heightening risks of solar flares. Here’s what risk managers need to know

A version of this article previously appeared in our sister publication, Insurance Times

Imagine waking up tomorrow to a seemingly post-apocalyptic world – business has come to a halt, the power grids are down and no one can find a working radio or access the internet.

These would be just some of the impacts of a long-lasting radiation storm, created by a x-class solar flare directed at the planet.

What is a solar flare?

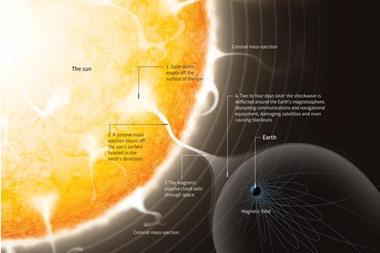

According to the European Space Agency (ESA), a solar flare is a “tremendous explosion on the sun that happens when energy stored in twisted magnetic fields – usually above sunspots – is suddenly released”.

There are three categories in which the ESA classifies solar flares according to their brightness in the x-ray wavelengths – this includes the largest x-class flares, medium-sized m-class flares and smaller c-class flares, which the ESA said “cause few noticeable consequences here on earth”.

“The category that should cause the worry would be x-class flares,” said Andrew Siffert, senior vice president and senior meteorologist at specialist insurance and reinsurance broker BMS Group.

NASA stated that the amount of solar flares would increase around every 11 years – forming a solar maximum. The last solar maximum occurred between 2012 and 2014.

What are the main risks for businesses?

In the most extreme and rare events, significant risks could occur.

RSA’s head of underwriting strategy Michael Gregory, said these include national blackouts, loss or disruption to services reliant on satellite-enabled technologies, damage to trans-oceanic communication cables, possible damage or total failure of satellites, disruption of global navigation satellite systems (GNSS) positioning – impacting ships and aircraft – and damaged mobile communication networks.

All this means that essential services could be disrupted – including transport, retail, finance, energy and communications.

Gregory further noted that a solar flare event could see radiation increase high in the atmosphere, which could affect aircraft passengers and crew.

“One can only imagine what would happen if large parts of some countries were without power for months”

Previous solar flare incidences show how bad the business interruption could be.

In December 2006, NASA stated x-class flares caused a coronal mass ejection (CME), which interfered with GPS signals being sent to ground-based receivers.

And three years earlier in October and November, the most intense solar flare on record – dubbed the Halloween Storms of 2003 – impacted the aviation industry in both the UK and the US.

In the UK, for instance, the Parliamentary Office of Science and Technology reported in July 2010 that the compass north changed temporarily by five degrees in six minutes.

One Japanese satellite costing $640m, furthermore, was permanently damaged.

“Some might say solar flares are even worse than issues like climate change because there is no way to completely eliminate the risks of solar flare storms”

The Quebec Blackout Storm in March 1989 also saw residents in Canada experience an electrical blackout for nine hours and transport links were shutdown.

Siffert explained the risks need to be better understood, considering that the occurrence of a solar flare storm was “just as plausible in a lifetime as the main industry topics like climate change”.

“One can only imagine what would happen if large parts of some countries were without power for months,” he added.

“Some might say solar flares are even worse than issues like climate change because there is no way to completely eliminate the risks of solar flare storms.”

Why better collaboration between risk managers and insurers can help

Despite the unknowns, Siffert acknowledged that it was “not all doom and gloom”.

He said that in general, there had been “significant steps taken to mitigate the risk from solar storms” – such as “better detection of the events and the gardening of known possible failure points like better electrical grid monitoring”.

He also felt there was a “real opportunity” for insurance firms to take a different look at risk by collaborating with scientists and engineers to “help protect our society” from the potential impacts.

“If the insurance industry better understands the impacts and threats, it can help society address these challenges,” he said.

”The insurance industry has a key role to play in alerting clients to the risks that solar flares present to their operations”

“This would also allow the industry to develop specialised coverage solutions and improve disaster response strategies related to solar flares and their potential impacts.”

Gregory added that “like any risk on the radar, opportunities are as much about education and furthering knowledge as they are about mitigation”.

“In the short-term, the insurance industry has a key role to play in alerting clients to the risks that solar flares present to their operations, supporting them in mitigating these risks and ultimately providing coverage and risk transfer solutions,” he said.

“Brokers, [in particular], have a critical role they play in informing and educating customers, given they have the opportunity to get ahead of emerging risks such as solar flares, providing their clients with appropriate support in ensuring that their businesses, operations and people are protected.”

Source

No comments yet