New energy vulnerability index can help risk managers to identify potential risks, challenges and opportunities before expanding into new markets

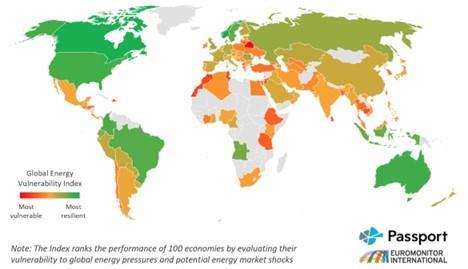

Market research company Euromonitor International has released its first-ever Global Energy Vulnerability Index, revealing individual countries’ exposure to energy shocks.

The index is designed to help businesses assess and benchmark a country’s energy security, providing insights into potential risks, challenges and opportunities in markets where they operate or plan to expand into in the future.

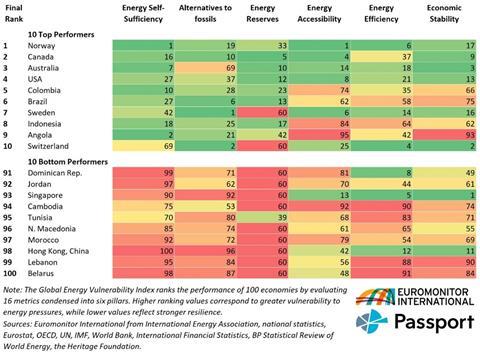

Euromonitor International used six groups of indicators to measure each country’s level of energy vulnerability:

- Energy self-sufficiency (30% of total score (TS)),

- Alternatives to fossils (35% TS),

- Energy reserves potential (10% TS),

- Energy accessibility (5% TS),

- Energy efficiency (10% TS), and

- Economic resilience (10% TS)

Norway, Canada, Australia and the US rank at the top of the index due to their strong energy self-sufficiency, ample energy resources, diverse energy mix and high economic resilience.

At the other end of the table¸ Belarus and Lebanon rank at the bottom, as both countries lack energy resources and struggle with poor energy efficiency and economic uncertainty.

Singapore and Hong Kong also ranked among the bottom 10 performers because of their heavy reliance on energy imports, despite their high energy efficiency and economic stability scores.

“Although many European countries are better positioned to weather disruptions, the region’s high reliance on energy imports raises its exposure to energy shocks”

The smaller size of Singapore and Hong Kong also limits renewables capacity, adding to the city-states’ weaknesses.

Aleksandra Svidler, consultant for economies at Euromonitor International, added that European countries also face significant challenges.

He said: “Although many European countries are better positioned to weather disruptions due to the rising renewables adoption and better access to capital, the region’s high reliance on energy imports raises its exposure to energy shocks.

“Many African countries continue to grapple with underdeveloped infrastructure, poor access to reliable and affordable energy and low investment while developing Asian economies continue to struggle with low self-sufficiency rates, high dependency on fossil fuels and limited access to capital.”

What it means for risk managers

Svidler said: “Understanding a country or region’s vulnerability to energy shocks will inform business strategy and enable an optimal plan for energy sourcing, as well as help to identify the white spaces for investment.

“Overall, economies that are heavily reliant on imports, with low adoption of renewables, weak energy efficiency and economic instability are more vulnerable to energy risks.”

Understanding the data

Euromonitor International selected six groups of indicators to measure each country’s energy vulnerability. Low energy self-sufficiency, due to the weak domestic energy production and high reliance on imports, raises the exposure of an economy to disruptions in energy supply, global price shocks and geopolitical risks.

High reliance on a single external energy supplier particularly undermines an economy’s energy security.

Alternatives to fossils reflect the diversification of an energy mix away from fossil fuels by investing in alternative sources, such as green renewables or nuclear power, which can help to raise energy security, reduce exposure to global energy price and supply shocks, and enhance sustainability.

Energy reserves potential helps to assess the future availability of energy resources at current production rates. Reserves of oil, gas and coal can play a key role in boosting energy self-sufficiency of a country. Yet, high resource potential does not necessarily guarantee sufficient future supply due to economical, technological and environmental constraints.

Energy accessibility illustrates the reliability and adequacy of power supply in a country and points to the state of energy infrastructure. Lack of access to power and underdeveloped energy infrastructure can lead to significant social and economic challenges.

Energy efficiency indicates the amount of energy needed to provide goods and services. Higher energy efficiency can help to reduce energy consumption, and therefore reduce costs and reliance on imports, boost competitiveness and environmental benefits.

Countries with greater economic resilience are better equipped to withstand energy price and supply fluctuations, as available mechanisms and reserves allow them to manage energy market shocks. Meanwhile, higher economic freedom fosters investment in innovation and diversification.

How risk managers can mitigate energy vulnerability risks

Companies can enhance their energy security and long-term resilience by assessing the stability of their business, industry and market against potential energy shocks and planning for different scenarios.

Effective measures include contingency planning and diversification of energy supply, hedging energy prices, securing favourable energy rates and identifying reliable energy providers, which offer competitive pricing structures.

Meanwhile, keeping sufficient financial reserves can help minimise the impact of potential price shocks.

By assessing geographical vulnerability to energy shocks, companies can focus on adjusting strategies to reduce exposure to vulnerable countries and regions. For example, decentralised solutions, such as energy storage systems or on-site renewable energy generation can help to reduce grid reliance in susceptible markets.

Risk managers can also explore resilient markets for expansion or relocation opportunities and look for alternative suppliers to strengthen their supply chain resilience.

Capitalising on government assistance programmes, such as subsidies, tax incentives or low-interest loans, helps to effectively navigate immediate crises and also bolster long-term resilience.

Source

No comments yet