Instability in the Arab world is affecting the strategic risk exposures for businesses across the globe by creating instability in the energy markets and by inspiring political unrest

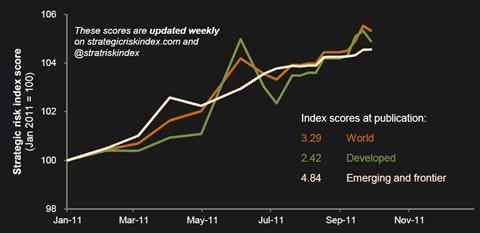

Strategic risks around the world have increased by five percent since the start of the year, according to a new risk index by Aegis Advisory and Integro Insurance.

The research found that almost all the companies that were assessed said risk is a higher priority than it was two years ago.

Rich and poor countries alike have seen similar increase in their respective strategic risk levels, according to the research.

Developed markets have seen their strategic risk levels increase by 4% and the largest emerging markets by 5%.

Both numbers reflect the current turbulence in the global financial markets, said Aegis.

The Strategic Risk Index was compiled using the Aegis Strategic Risk Assessment model (ASTRA), which quantifies risk levels across 30 different factors on a 1-10 scale.

When many businesses from developed economies such as the UK are looking for export growth from emerging and frontier markets, increasing riskiness is a major factor and a significant barrier to business

Richard Ayton, Managing Director of Aegis Advisory

The world strategic risk score rose from 3.1 at the beginning of the year to 3.3 at the end of September 2011.

According to the study, instability in the Arab world is affecting the strategic risk exposures for businesses across the globe by creating instability in the energy markets and by inspiring political unrest in countries like Chile, the US, Spain and Greece.

“When many businesses from developed economies such as the UK are looking for export growth from emerging and frontier markets, increasing riskiness is a major factor and a significant barrier to business,” commented Richard Ayton, Managing Director of Aegis Advisory.

Assessing the potential exposure to strategic risk across the world, the index is touted as a tool for companies planning to expand into new markets. The scores are updated weekly on strategicriskindex.com.

What is a strategic risk?

Strategic risks are generally held to be the impact (both positive and negative) on a company arising from adverse business decisions, incorrect implementation of decisions or a lack of responsiveness to changes in the business climate. These risks are the result of an organisation’s strategic goals as well as the decisions taken and resources deployed to meet those goals. Economic, technological, competitive, regulatory and environmental issues all affect strategic risk.

No comments yet