At the end of last year estimated pension plan assets declined to $1.2 trillion compared with liabilities of $1.6 trillion

The chaos in the world’s markets has had a major impact on pension plan funding and will negatively impact corporate earnings in 2009, according to estimates by Mercer.

Pension plans sponsored by the largest US companies have seen a decline in funded status (the ratio of assets to liabilities) from 104 % at year-end 2007 to 75 % at the end of last year, according to the firm.

This equates to losses of an estimated $469bn over 2008. An aggregate surplus of $60bn at the end of 2007 has been replaced by an estimated aggregate deficit of $409bn at the end of 2008, said Mercer.

“The decline in funded status will be capitalized and reflected in corporate balance sheets for many companies. This will reduce balance sheet strength, which leads to consequences for several areas of the business, including capital expenditure decisions, loan covenants and credit rating decisions,” said Adrian Hartshorn, of Mercer’s financial strategy group.

He added that pension expense will reduce corporate profitability and reported earnings in 2009.

The study shows that pension expense is likely to increase to an estimated $70bn in 2009.

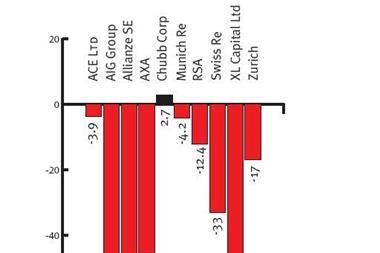

The S&P 500 index was down almost 40 percent through 2008, a decline typical of nearly all of the world’s major equity indices.

Declining equity markets have been the main driver behind asset losses of pension plans, said Mercer. Rising corporate bond yields benefited pension plans through much of 2008 but a rapid reduction in yields in the fourth quarter has largely eliminated this gain, added the consultant.

The total value of US pension plan assets at December 31, 2007, was $1.66 trillion, compared to the total value of the liabilities of $1.60 trillion. At December 31, 2008, the estimated assets had declined to $1.21 trillion, compared with estimated liabilities of $1.62 trillion, according to Mercer.

Mercer said corporate sponsors should review the financial risks they are taking in their pension plans, and their tolerance for doing so.

No comments yet