Exposure, the governing factor An almost explosive growth in the values of property in flood-prone areas and the much greater vulnerability of the things that people own are the main reasons for rising flood losses. By Wolfgang Kron

A natural catastrophe can only occur if two conditions are met: first, an extreme natural hazard event and, second, the presence of vulnerable values (human beings and/or property). In an uninhabited valley, a flood is simply a natural event, however large, whereas in an inadequately protected city, even a moderate event can trigger a natural catastrophe. In other words, the risk is small if the hazard, the value at risk or the vulnerability is small. The first is determined by nature, the second by human activity and the third can be influenced by preventive measures.

For practical purposes, risk is calculated as: The product of the probability of a certain hazard occurring at a specific location, the values at risk (= exposure) and their vulnerability. The total flood risk for a given area, therefore, is found by integrating the consequences of all possible events at any location in the area.

Why the increase in flood losses?

August 2002: Elbe and Danube catchments experience floods of the century - 17 billion euros damage in Germany, Austria and Czech Republic.

August 2005: Switzerland suffers its largest loss in history due to torrential rainfall - 2 billion euros damage.

July 2007: The small town of Baiersdorf in southern Germany, on a flat plane finds itself up to 2m under water in less than an hour after a local downburst - 100 million euros damage.

June/July 2007: Large areas of the United Kingdom flooded, many with no river in sight - altogether 5.5 billion euros damage.

Record breaking losses every year, everywhere. Is this climate change striking? Is the number of extreme precipitation events rising dramatically? There is no doubt that climatic changes are responsible for an increase in extreme weather conditions in frequency and intensity, but they are only one part of the story. The principal cause is the development of people's property values and behaviour, and the susceptibility of the assets to water.

First, there is a direct correlation between the increase in losses and the number of people who live in areas at risk. While the population pressure often leaves the people in poor countries with no other choice than to settle in exposed areas, other factors provide the motivation in industrial countries.

Flood valleys are usually cheap as building land, attractive and easy to develop. They offer good conditions for establishing the necessary infrastructure. The proximity of a river is particularly advantageous for commercial and industrial facilities that need large amounts of space and sometimes process or cooling water. Larger rivers and the sea also offer the possibility of transporting freight by ship.

Towns and cities have an interest in their own growth and prosperity. They have to make land available for housing or for commercial and industrial facilities. Many property owners are either unaware that there is a danger of flooding, because they assume that if land is released for development it will be safe, they ignore the danger or forget it if nothing untoward happens. Only when a dangerous situation arises or there is a loss are people shaken awake.

Moreover, many people still believe that flood events can be controlled with appropriate technological precautions. The positive effect of flood control is that it prevents frequent losses and discomfort, but it creates a feeling of security that leads people to expose ever more high value objects to the risk of flood. This feeling of security comes not only from physical protection such as by dykes, early-warning systems, and the availability of disaster relief, but also from the transmission of misleading information by local authorities or groups with a vested interest, in playing down the risk, such as the tourist trade.

Never before have people had so many valuable but, at the same time, vulnerable possessions. Private homes are full of expensive objects and electronic devices, while commercial buildings often accommodate car parks, storage rooms and sometimes even computer centres below ground. Many such objects become a total loss if exposed to water.

Today, there is hardly anywhere - at least in Europe - where there is no flood risk, simply because there are valuable assets - settlements, industrial parks, infrastructure, and agricultural and recreation areas - practically everywhere.

For the insurance industry, property losses are the most important source of claims. Insured flood losses, in contrast to those from windstorm, usually assume a relatively small percentage of the total losses of an extreme event now. The main reason is that only a small proportion of the losses to public infrastructure, roads, railway tracks, river banks and dykes, bridges, fresh and waste water pipes, and oil and gas distribution networks is insured. Besides, in most European countries, there is a low penetration of flood cover, with the exception of the United Kingdom where the large majority of households is insured.

However, flooded roads and railroads can keep employees from their workplaces and prevent the movement of goods to and from production sites. Thus, they can cause contingent business interruption losses. The amount of insured contingent business interruption losses after Hurricane Katrina in 2005 was astonishing: cable TV and credit card companies claimed hundreds of millions of dollars because they could no longer make a profit in the areas struck by the disaster.

Prevention strategies against flood

Floods are a part of the natural water cycle, but mankind has ways of intervening in this cycle. They include

• Influencing the climate, resulting in more frequent and more intense precipitation.

• Changing the infiltration capacity of the soil, for example by paving and soil being compacted by agricultural activities,

• Discharging water into rivers and lakes by means of drainage ditches, sewers, and directing it towards the sea, for example by river regulation and removal of flood retention areas.

Flooding occurs when the soil is saturated, or a lake or a river overflows. The water then stands or flows into areas that are usually dry. Even when this does happen, we can keep losses within reasonable limits, if we have a suitable prevention strategy which embraces all aspects of floods, from their genesis to the minimising of loss potentials.

Retaining water must have top priority whenever possible. One thing must be noted, however: extreme floods in large catchments are only marginally attributable to surfaces that have been made impervious by human activity. Likewise, the masses of water flowing down large rivers during floods are sometimes so huge that decentralised flood retention, river restoration and dyke relocation can only reduce the extreme flood peaks to a limited degree.

Ways of mitigating flood by technological measures include retaining water at specially designated places, such as flood detention areas, polders and reservoirs, and directing flood waters by means of dykes within a predetermined area, possibly with flood channels.

All these measures use what is called a design flood, which is a relatively high flood value, typically expressed as a return period, as the basis of protection. If an event exceeds the design value, flood control may be ineffective. Climate change effects will require adequate response to recurrent extreme events in the form of upgraded engineering works, but there are also places where resettlement should (and must) be considered.

The most effective way of preventing damage is, in fact, to keep people and their property away from flood-prone areas, i.e. with an appropriate land-use policy that does not permit building development near bodies of water. Elsewhere, permanent and temporary structural measures, adjusting the management of assets and appropriate responses to danger, such as evacuating threatened parts of buildings, can still achieve much. Even so, a residual risk will remain, and this is where insurance comes in.

No way around: the risk partnership

To make effective disaster reduction possible, three partners, the state, the people affected and the insurance industry must cooperate in a finely tuned partnership. Reducing the underlying risk for society as a whole is primarily the job of the state. It sets up observation and early-warning systems, controls flood discharge and, by statutory provisions, determines the framework for the use of exposed areas. Those affected are obliged to make their own contribution to loss prevention by building in an appropriate manner, preparing for emergencies and taking action once disaster strikes.

Finally, insurance companies should be on hand to compensate financial losses that would have a substantial impact on insureds or even constitute their ruin. This means that although insurers are not social institutions in the sense of charities, they are indispensable institutions within the social system.

Faced with increasing public demand for insurance coverage but determined to maintain proper underwriting, the insurance industry is looking for ways to develop solutions for flood coverage. Various countries have already established insurance schemes for this type of hazard, some in the form of insurance pools, others on an individual basis. Types of contracts range from obligatory to completely voluntary, and from all-risks to flood-only.

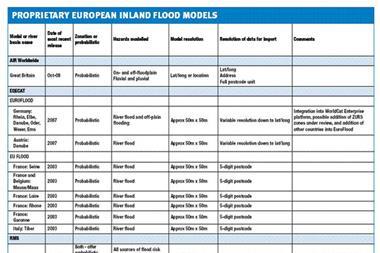

To underwrite flood, insurance companies must anticipate where losses are likely to occur and how large they can be. Since about 2000, the insurance industries in a growing number of European countries have developed flood hazard classification maps and recommendations for premiums. At the same time, accumulation models to assess probable maximum losses (PML) have become available. Examples of PML models are the German HQ-Kumul, the Austrian HORA-Kumul and the Italian SIGRA models, all of the second generation type, i.e. stochastic models.

In Germany gauge recordings at 131 sites over more than 40 years were analysed and the 100 most significant flood events identified. Based on the statistical properties of these 100 events, a set of 10,000 synthetic events was generated. By extension to other regions, the local return period for every reach of the underlying river network, with a total length of more than 50,000km, was determined. Given the local return period, it is possible to find the respective flooded area using flood hazard maps, and estimate the expected losses in the affected area. Applying 10,000 flood events to a given portfolio yields 10,000 event losses. By sorting these in the order of size, one obtains an empirical PML curve, from which losses for a given return period can be derived (Figure 1).

Ever more: off-plain and flash floods

We know that tropical storm Allison caused $6 billion damage in Houston, Texas in June 2001, and the 12 hour downpour on 25 July 2005 in Mumbai left a bill of $5 billion for an area of little more than 30km diameter. Various regions of Europe are also vulnerable to flash flooding. High intensity precipitation has occurred frequently in recent years, with losses of hundreds of millions to billions of euros - even for single events.

One factor governing these losses is surprise. The affected areas are often far from a river. The inundation is not the result of an overflowing water-course, but because flat slopes reduce natural drainage and urban drainage fails due to insufficient storm water system capacity.

The water accumulates where it falls or it is backed up. There is no real solution to this problem. The type of flooding that is off plain or not river bound is difficult, if not impossible, to avoid.

This situation, however, is the ideal starting point for flood insurance, because everyone is threatened, usually with a rather low probability. Premiums, therefore, can be low, if there is broad and high insurance penetration. Achieving this, however, is not easy. Awareness of flood risk is very low among those who do not live next to a water-course, a lake or the sea. It will be the challenge not only for the insurance industry, but even more for societies as a whole to spread risk awareness and, as a consequence, promote insurance. I believe information alone is not sufficient. There must be incentives, such as tax deductibles, and, perhaps, even regulations so that people in seemingly safe areas (that are not safe) buy insurance cover.

Living with hazard and risk

Even if human activity is partly responsible for many catastrophes, our errors are not all to blame. We simply have to get accustomed to living with extreme, even catastrophic, natural events and refrain from placing our hopes on – or our trust in – controlling these kinds of events by technological or other means. Catastrophes are not only products of chance, but also the outcome of the interaction of political, financial, social, technical and natural circumstances. Effective safeguards are both achievable and indispensable, but they will never provide complete protection. The decisive point is the awareness that nature can always come up with events against which no human means can prevail. As Greek philosopher Aristotle (384–322 BC) said, "It is probable that the improbable will happen." Coping with this type of improbability is the main task of insurance.

Building Precautions That Work

Building adaptations can reduce damage even for major events, researchers from Potsdam’s GeoForschungsZentrum led by Heidi Kreibich, found from a study of the 2002 flood of the River Elbe and its tributaries. The researchers interviewed about 1,200 private householders affected by the flood because data about effectiveness such measures are rare, and consequently, their comparative efficiency is uncertain.

The affected households had not generally been well prepared. Only 15% had previous experience of flood, and 59% stated that they did not know that they lived in a flood prone area. Just 11% had used and furnished their house in a flood adapted way, and only 6% had a flood adapted building structure, the researchers said in their report published in Hazards and Earth Systems Sciences in January 2005.

They concluded that building precautionary measures are mainly effective in areas with frequent small floods, but even during the extreme event in 2002, they did reduce losses. Flood adapted use and adapted interior fittings reduced the damage ratio for buildings by 46% and 53%, respectively. For contents, the damage ratio was reduced by 48% as a result of flood adapted use and by 53% due to adapted interior fitting.

“The 2002 flood motivated a relatively large number of people to implement private precautionary measures, but still much more could be done. Hence, to further reduce flood losses, people’s motivation to invest in precautions should be improved. More information campaigns and financial incentives should be issued to encourage precautionary measures,†commented the report.

Flood loss reduction of private households due to building precautionary measures – lessons learned from the Elbe flood in August 2002, Natural Hazards and Earth Systems Sciences.

Hedi Kreibich: kreib@gfz-potsdam.de

Postscript

Wolfgang Kron is head of hydrological risks in Munich Re’s Geo Risks Research Department.

Email: wkron@munichre.com

www.munichre.com

No comments yet